Understanding Budget Wedding Planning

Saving for a wedding on a budget involves strategic financial planning, prioritization, and disciplined spending. A budget wedding refers to organizing a wedding celebration with limited financial resources, typically below the national average wedding cost, which in the U.S. is approximately $30,000 as of recent surveys. The goal is to create a memorable event without incurring unnecessary debt or sacrificing financial stability.

A core term in this context is “wedding fund” — a dedicated savings account or envelope used exclusively for wedding-related expenses. Unlike general savings, this fund focuses on short-term, event-specific goals, which require a more aggressive and organized saving approach. Another essential concept is “cost optimization,” which differs from cost-cutting: it means maximizing value for money rather than simply choosing the cheapest option.

Visualizing the Wedding Budget Structure

Imagine a pie chart where the total wedding cost is divided into key categories: venue (35%), catering (25%), attire (10%), photography (10%), and miscellaneous (20%). This visual structure helps couples allocate funds intentionally and makes it easier to identify savings opportunities.

For example:

– If the average venue cost is $10,000, a budget-conscious couple might aim to spend $3,000–$5,000 by choosing a community center or a backyard wedding.

– Adjusting the pie portions by prioritizing what’s most important (e.g., photography over décor) enables financial control.

This diagrammatic thinking encourages couples to set spending caps for each category and track progress visually through monthly updates.

Comparison: Budget Wedding vs. Traditional Wedding

A traditional wedding often includes luxury elements such as a sit-down multi-course dinner, designer attire, and premium venues. In contrast, a budget wedding emphasizes practicality, resourcefulness, and value-driven choices.

Key differences include:

– Venue: Traditional = banquet hall; Budget = public park or family backyard.

– Catering: Traditional = plated meals; Budget = buffet or potluck-style.

– Décor: Traditional = professional florist; Budget = DIY décor using seasonal flowers.

While traditional weddings may offer more convenience through outsourced vendors, budget weddings provide greater customization and personal involvement, which can result in a more meaningful celebration.

Step-by-Step Guide to Saving for a Budget Wedding

To successfully save for a wedding on a limited budget, couples must adopt a structured plan. The following steps outline a practical savings roadmap:

1. Set a Realistic Budget

Determine the total amount you can afford without borrowing. Consider your current income, fixed expenses, and how much you can save monthly. Tools like budgeting apps (e.g., YNAB or Mint) can automate tracking and help identify areas to trim.

2. Open a Dedicated Wedding Savings Account

Keep wedding savings separate from regular accounts to avoid accidental overspending. High-yield savings accounts or digital envelopes can help grow funds with minimal risk while maintaining liquidity.

3. Automate Monthly Contributions

Set up automatic transfers aligned with your payday to ensure consistent saving. Even small regular deposits — $100 to $300 per month — can accumulate significantly over 12–18 months.

*Benefits of automation include:*

– Removes emotion from saving decisions

– Builds discipline

– Mitigates the risk of spending funds elsewhere

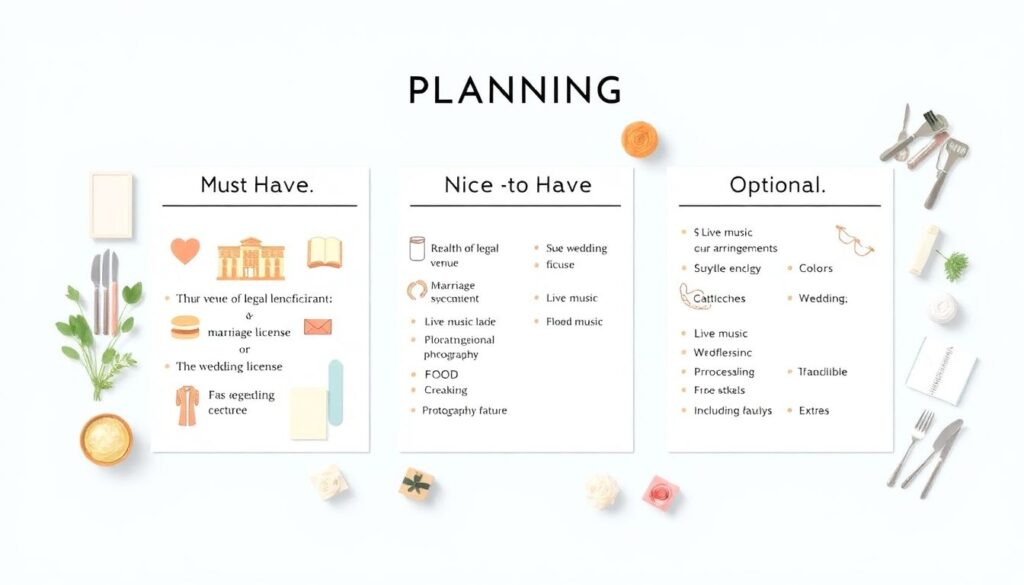

4. Use a Tiered Priority System

Rank each wedding element as “Must-Have,” “Nice-to-Have,” or “Optional.” Focus your budget first on essentials like the venue and marriage license. Then, allocate remaining funds based on available savings.

*For example:*

– Must-Have: legal officiant, food, basic attire

– Nice-to-Have: live music, floral arch

– Optional: professional videographer

This system prevents overspending on less impactful elements and ensures your core vision is achieved first.

Creative Strategies to Maximize Savings

Beyond traditional budgeting, couples can explore creative solutions to stretch their funds without compromising quality.

Ideas include:

– Off-peak scheduling: Choose a weekday or offseason date to save up to 40% on venue and vendor costs.

– Crowdsourcing skills: Ask talented friends to contribute services like photography, DJing, or baking.

– Pre-owned attire: Shop for secondhand wedding dresses or rent formalwear to cut attire costs by 70%.

Additionally, consider digital invitations to eliminate printing and postage expenses. Free design platforms like Canva offer elegant templates suitable for weddings.

Case Example: A $5,000 Wedding Plan

Suppose a couple has 12 months to save for a wedding with a $5,000 total budget. By saving approximately $420 monthly, they can cover the following:

– Venue: $1,000 (local community center)

– Catering: $1,200 (buffet-style with limited menu)

– Attire: $500 (groom and bride combined)

– Photographer: $800 (freelancer or student)

– Décor & Misc.: $1,000

– Emergency buffer: $500

This example demonstrates how disciplined saving and cost-conscious choices can produce a beautiful, memorable event without financial strain.

Long-Term Benefits of Budget-Conscious Planning

Planning a budget wedding isn’t just about saving money — it’s about setting a precedent for financial collaboration in marriage. Couples who plan together enhance communication, trust, and shared responsibility. Moreover, avoiding debt from the start can strengthen long-term financial health and reduce post-wedding stress.

Ultimately, a thoughtfully planned budget wedding proves that with creativity, discipline, and prioritization, it’s possible to celebrate love in a meaningful way without compromising future financial goals.