Budgeting for Large Purchases: Cars

Buying a car is one of the most significant financial decisions many people make outside of purchasing a home. Whether you’re eyeing a brand-new SUV or a reliable used sedan, approaching the purchase with a solid budgeting strategy can save you thousands of dollars and prevent long-term financial strain. In this article, we’ll explore different budgeting techniques, compare financing vs. paying in cash, and walk through real-world examples to help you make a smart, informed decision.

Understanding the True Cost of a Car

When budgeting for a vehicle, many buyers focus solely on the sticker price. However, the actual cost of owning a car extends far beyond the initial purchase.

Ongoing Costs to Consider:

– Insurance premiums (can vary widely by age, location, and car model)

– Fuel and maintenance (oil changes, tires, repairs)

– Registration and taxes

– Depreciation (most new cars lose 20% of their value in the first year)

For example, buying a $25,000 car might actually cost around $33,000 over five years when you factor in insurance, fuel, and maintenance. That’s why budgeting must account for the full picture.

Approach #1: Save First, Buy Later (Cash Purchase)

This traditional method involves delaying the purchase until you’ve saved enough to buy the car outright. It’s the most financially conservative strategy and eliminates the burden of monthly payments.

Pros:

– No interest payments or loan fees

– Full ownership from day one

– Easier to negotiate discounts with dealerships

Cons:

– Requires patience and discipline

– May delay access to reliable transportation

– Savings could be depleted, reducing emergency funds

Real-life example:

Anna, a freelance graphic designer, saved $400/month for two years and bought a used Honda Civic for $9,500 in cash. She avoided debt entirely and kept her monthly expenses low, which helped her maintain flexibility during slow business months.

Approach #2: Financing Through a Loan

Taking out an auto loan allows you to buy a car sooner by spreading the cost over several years. It’s a common path, especially for buyers who need a car immediately for work or family needs.

Key Loan Terms to Understand:

– APR (Annual Percentage Rate): Total cost of borrowing, including interest and fees

– Loan Term: Length of the loan, typically 36–72 months

– Down Payment: Initial payment that reduces the loan amount

Pros:

– Immediate access to a vehicle

– Can afford a newer or more reliable car

– Opportunity to build credit history

Cons:

– Interest adds to total cost

– Risk of negative equity if car depreciates faster than loan is paid

– Requires consistent income to cover monthly payments

Example:

Mark, a software engineer, financed a $30,000 Toyota RAV4 with a 5-year loan at 4.5% APR. He made a $5,000 down payment and pays $464/month. Over the loan term, he’ll pay around $2,800 in interest, bringing the total cost to roughly $32,800.

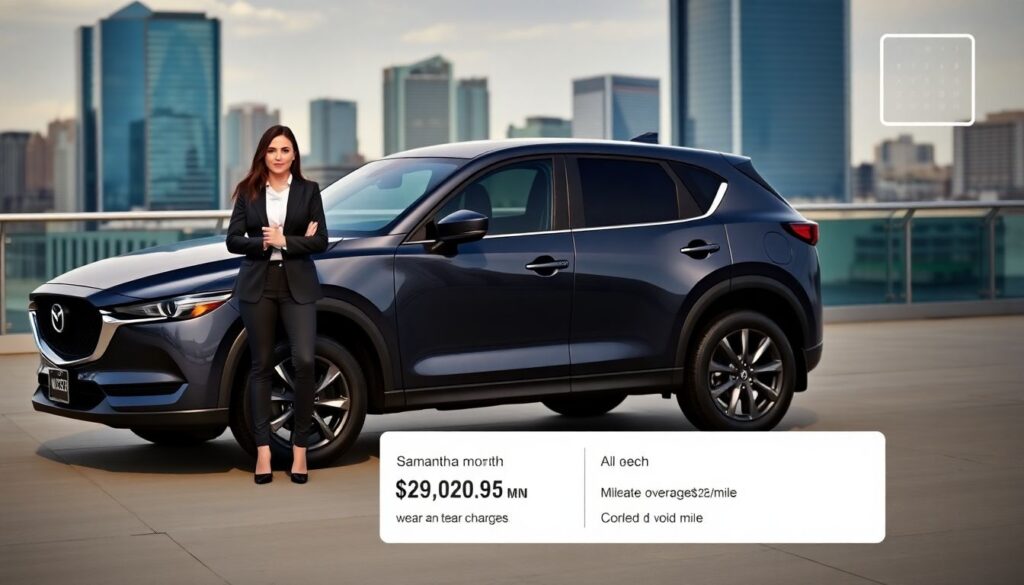

Approach #3: Lease Instead of Buy

Leasing is essentially renting a car for a fixed period (usually 2–3 years). Monthly payments are generally lower than loan payments, but you don’t own the vehicle at the end.

When Leasing Makes Sense:

– You prefer driving newer cars every few years

– You don’t drive more than 10,000–15,000 miles per year

– You want lower monthly payments

Risks to Watch Out For:

– Mileage overages can be expensive (up to $0.25/mile)

– Wear-and-tear charges at lease-end

– No asset ownership

Example:

Samantha, a marketing executive, leases a new Mazda CX-5 for $299/month with $2,000 down. Over three years, she’ll spend about $12,764 but will return the car at lease-end. If she decides to buy the same car after leasing, she may end up paying more than if she had financed it from the beginning.

How to Choose the Right Strategy

There is no one-size-fits-all solution. The right approach depends on your financial goals, income stability, and lifestyle.

Ask Yourself:

– Can I comfortably afford the monthly payment (including insurance)?

– Do I have an emergency fund in place?

– How long do I plan to keep the car?

– Is this purchase urgent or can it wait?

Budgeting Framework: The 20/4/10 Rule

A popular guideline for car buying is the 20/4/10 rule:

– Put down 20% of the car’s price

– Finance for no more than 4 years

– Keep total transportation costs under 10% of your monthly income

For example, if your monthly income is $4,000, your car-related expenses (loan, insurance, fuel) should stay below $400/month.

Final Thoughts

Budgeting for a car is not just about affording the purchase today—it’s about ensuring it won’t compromise your financial health tomorrow. Whether you save up and pay in cash, finance with a loan, or opt for a lease, understanding the full cost and choosing a strategy that aligns with your long-term goals is key.

Remember: a car is a depreciating asset. The less money you tie up in it, the more flexibility you’ll have for investments, emergencies, or future opportunities. Make the numbers work for you—not the other way around.