Why Saving for a Down Payment While Renting Is Hard — And Totally Possible

Saving for a down payment while paying rent can feel like trying to fill a bucket that has a slow leak. The rent goes out every month, prices keep rising, and the idea of owning a place feels distant. But here’s the truth: people in very similar circumstances to yours manage to buy homes every year — not потому что им везет, а потому что они строят систему.

In other words, instead of asking “Can I do this?”, it’s more полезно спросить: “Что именно мне нужно изменить, чтобы это стало реальным?” This article is about building that system — a realistic, flexible, and motivating down payment savings plan for renters.

—

Case Study #1: How Emily Turned a “Barely Getting By” Budget into a Down Payment

Emily was 29, lived in a mid-priced city, and paid $1,400 in rent. Her net income was about $3,300 a month. She was convinced homeownership was at least 7–10 years away.

Then she did one thing that changed everything: she treated the future down payment like a non‑negotiable bill, not an optional “leftover” expense.

Here’s how she approached how to save for a down payment while renting:

– She opened a separate high‑yield savings account and nicknamed it “Home Fund – Do Not Touch”.

– She automated a transfer of $350 the day after payday.

– She committed to reevaluating her progress every 3 months, not every few days.

At first, $350 didn’t feel like much. But once it became habitual, she looked for ways to grow that number, not by suffering, but by making targeted changes.

Over 26 months, including a small annual bonus and a tax refund, Emily saved just over $12,000. That wasn’t enough to pay for the entire down payment, but it was enough to qualify for a low‑down‑payment mortgage — and, combined with a modest local grant, it got her into a small condo.

The key takeaway: she didn’t start with a perfect plan. She started with *a* plan, then refined it.

—

Step One: Get Clear on Your Target Number

It’s almost impossible to stay consistent when your goal is fuzzy. So before cutting coffee or hunting discounts, you need to understand how much to save for a down payment on a house in your price range.

Run the Numbers, Then Reality-Check Them

Let’s say you’re looking at homes around $300,000. Common down payment options might include:

– 3–5% for many conventional or government‑backed mortgages

– 10–20% if you want to reduce or avoid mortgage insurance and improve terms

If you aim for 5%, that’s $15,000. Add closing costs (often 2–4% of the purchase price), and your total “get into the house” fund might be closer to $20,000–$25,000.

That number might feel big, but breaking it down softens the shock. For instance:

– $20,000 over 4 years = about $417/month

– $20,000 over 3 years = about $555/month

Now you’re no longer thinking in vague terms. You’re designing a down payment savings plan for renters that fits your income, your city, and your timeline.

—

Case Study #2: The Roommate Strategy That Cut Rent, Not Lifestyle

Jordan earned good money in tech but lived in an expensive rental downtown. He kept saying, “I’ll save when I make more.” Then, during a performance review, his manager casually mentioned owning a condo nearby. That triggered something.

Instead of chasing a bigger salary, Jordan looked at his biggest expense: rent.

He made one strategic move:

– He left his solo one‑bedroom apartment and moved into a two‑bedroom with a friend.

His rent dropped from $2,200 to $1,400. The new place wasn’t glamorous, but it was decent and in a safe neighborhood. Jordan decided that every dollar saved on housing would go straight into his home savings account.

Result:

– $800/month rent savings

– $800/month auto-transferred to his “Future Home” account

In 18 months, he accumulated roughly $14,400, plus a small return from interest. He combined that with a bonus and bought a starter condo. The move to a shared place wasn’t “fun” in the Instagram sense, but it was intentional — and time‑limited.

For many people, one of the best ways to save for a house deposit on rent is to rethink *where* and *how* they rent for a few years, rather than trying to squeeze savings out of already tight day‑to‑day spending.

—

Designing a Realistic Savings Blueprint

You don’t need a perfect budget, но вам нужна понятная логика: откуда деньги будут приходить и как вы будете избегать срывов.

1. Automate First, Adjust Later

Set up an automatic transfer to your “Home Fund” the day your paycheck lands. Start with a number that’s a bit uncomfortable but not impossible — something you can maintain for at least three months.

Then, after three months:

– If it feels easy, increase it by 10–20%.

– If it feels brutal and you’re racking up credit card debt, dial it back slightly, not to zero.

This keeps you in the game without burning out.

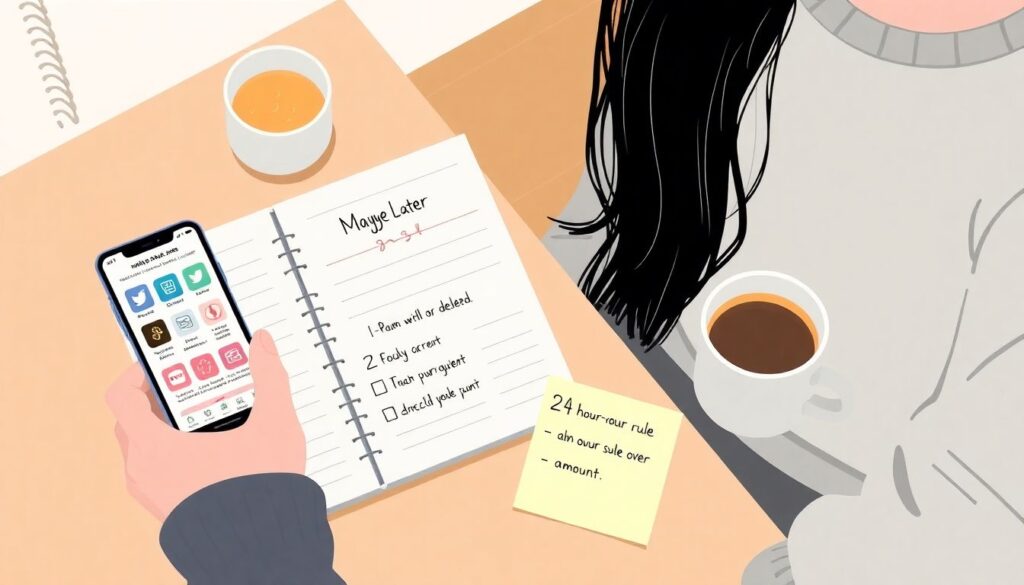

2. Build Friction Against Impulse Spending

You don’t have to stop all small pleasures, but you do want to slow down mindless spending. Try:

– Removing stored cards from shopping apps

– Adding a 24‑hour rule for non‑urgent purchases over a set amount

– Keeping a “Maybe Later” list instead of instant buying

The goal isn’t austerity; it’s *awareness*.

—

Case Study #3: Side Income as a Down Payment Accelerator

Priya worked full-time in marketing and earned a stable income, but high rent and student loans meant she could only set aside about $200 a month. At that pace, her dream house felt far away.

Instead of squeezing her existing budget to the breaking point, she asked a different question: “What can I do *outside* my 9‑to‑5 that directly feeds my down payment fund?”

Here’s what she did:

– Offered basic freelance marketing services for small local businesses

– Committed that 100% of side income would go into her Home Fund

– Set a modest goal: $400/month from side work

Within six months she was hitting, and occasionally exceeding, that goal. Her savings rate jumped from $200 to $600 a month. Over 2.5 years, her down payment fund grew past $18,000, enough to confidently enter her local market with a low‑down‑payment loan.

The main lesson: if your base budget is tight, growth often comes not from stripping everything bare, but from growing your income on your own terms.

—

Practical Tactics You Can Start This Month

Here’s a simple sequence you can follow in the next 30 days to start or upgrade your plan.

Clarify, Automate, Optimize

– Identify your target price range and rough down payment goal.

– Open a separate high‑yield savings account (with no debit card attached).

– Set an automatic monthly transfer, even if it’s small at first.

– Review your past 2–3 months of spending and flag expenses that add little to your life.

– Redirect a specific amount (not just “whatever is left”) from those cuts into your Home Fund.

Small but consistent decisions — not heroic one‑time sacrifices — are what move the needle.

—

Leveraging Down Payment Assistance and Other Hidden Boosters

A lot of renters assume they have to fund every dollar themselves. That’s not always true. Many places offer down payment assistance programs for renters who meet certain income or first‑time buyer criteria.

These can come in several forms:

– Grants you don’t have to repay

– Forgivable loans if you live in the home for a set number of years

– Low‑interest secondary loans to help with the down payment or closing costs

The analytical move here is simple: even if you *think* you won’t qualify, verify it with actual data. Many people self‑exclude based on myths or old information.

—

Resources for Learning and Strategy Building

If you’re serious about learning how to save for a down payment while renting, treat it like a mini‑course you’re taking on your own future. You don’t need a degree in finance, но нужны проверенные источники.

Where to Start

– Government or municipal housing websites:

Look up your city, county, or state/province + “first‑time homebuyer programs”.

– Reputable personal finance blogs and nonprofit organizations:

Focus on content that explains trade‑offs (like smaller vs. larger down payments), not on hype.

– First‑time homebuyer workshops:

Many banks, credit unions, and local nonprofits offer free or low‑cost seminars that cover budgeting, credit, mortgages, and assistance programs.

Use these resources not just to get inspired, but to pressure‑test your assumptions:

Are you overestimating how much you need? Underestimating your options? Missing cheaper neighborhoods that fit your real needs?

—

Mindset: Balancing Patience and Urgency

There’s a paradox in this journey: you need urgency to act now, but patience to see results. Если фокусироваться только на срочности — быстрее выгораешь. Если только на терпении — ничего не меняется.

Useful mindset shifts:

– See rent as a temporary tool, not a life sentence. You’re buying stability later by being strategic now.

– Treat every month as a data point, not a verdict. You’re analyzing, adjusting, and improving your system.

– Focus on *trajectory* more than perfection. A flawed but active plan beats a perfect plan that exists only in your head.

—

Pulling It All Together

Saving for a down payment while renting isn’t about heroism or deprivation. It’s about design:

– A number that makes sense for your market and your life

– A savings system that runs automatically

– Strategic adjustments to rent, income, and spending

– Smart use of available programs and resources

You’ve seen from the examples of Emily, Jordan, and Priya that there isn’t a single “correct” path. Emily optimized habits. Jordan restructured his living situation. Priya leveraged extra income. Each built a plan that suited their own constraints.

Your job isn’t to copy them; it’s to borrow the logic and apply it to your reality.

If you pause now and define your target, open a dedicated account, and set up the first automatic transfer — even a small one — you’re no longer just “hoping” to buy a home someday. You’ve started the project.

And projects, unlike dreams, have timelines, milestones, and progress.