Why Behavioral Insights Matter for Your Budget

The Science Behind Your Spending Habits

Most people don’t blow their budget because they’re bad at math; they blow it because of human psychology. Over the past three years, multiple surveys in the US and Europe have shown a stable pattern: only about 35–45% of adults follow any kind of written or digital budget, yet those who do are significantly more likely to feel financially secure. At the same time, around half of households report that an unexpected $400–$500 expense would be stressful. Behavioral insights tackle this gap: instead of asking you to become a robot, they adapt your budgeting system to real human tendencies like impulsivity, optimism bias and “I’ll start next month” thinking.

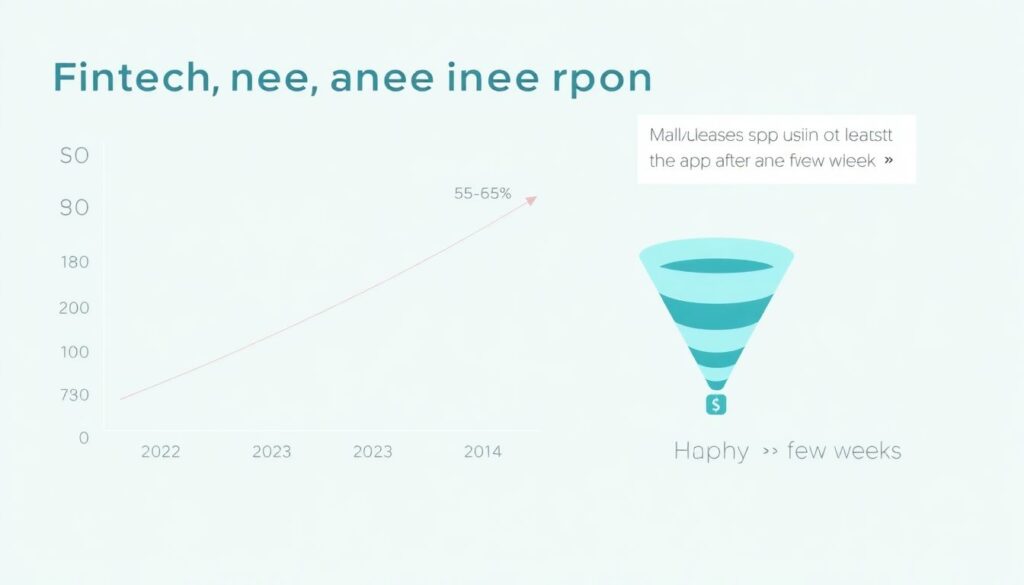

Recent Trends You Should Know

From 2022 to 2024, the share of people using fintech and budgeting apps has been climbing steadily, with many surveys converging around 55–65% of adults using at least one money app. But here’s the catch: a good portion of those users drop off after a few weeks. Data from app analytics firms show that retention is the real challenge, not sign-ups. That’s where behavioral finance budgeting tools stand out. They use nudges, reminders, friction and tiny rewards to keep you engaged long enough for new habits to stick. Better budgeting through behavioral insights isn’t about more features; it’s about fewer excuses and smarter default settings.

—

Necessary Tools for Behavior‑Smart Budgeting

Core Digital Tools You Actually Need

You don’t need a dozen apps, but you do need a simple stack that works with your brain instead of against it. Start with one primary budgeting app that syncs with your bank accounts and cards. Look for the best budgeting apps using behavioral insights: features like automatic categorization, spending alerts right after a purchase, “safe to spend” balances and gentle weekly check‑ins matter more than colorful dashboards. Add your bank’s mobile app for real-time balances and transfers, plus a cloud note app or simple spreadsheet for goals and reflection. Keep the toolset lean; every extra platform is another excuse to disengage when motivation dips.

Behavioral Support: Courses and Coaching

If you’ve tried to budget before and bounced off, consider adding a learning or coaching layer. A good behavioral economics personal finance course doesn’t just teach compound interest; it walks you through biases like loss aversion and present bias, then shows how to design your budget around them. Many people benefit from a financial planning service with behavioral coaching, where a planner or coach helps you translate numbers into routines: weekly money check‑ins, pre‑commitment to savings, guardrails for online shopping. Over the last three years, demand for coaching has grown notably, especially among millennials who prefer guidance plus automation instead of full DIY.

Low‑Tech Tools That Still Work

Behavioral budgeting isn’t only about apps. Low-tech tools like cash envelopes, a handwritten spending log for problem categories, or a printed “rules for payday” checklist can be surprisingly powerful. Studies in recent years have shown that simply writing down expenses by hand, even for one problematic area like food delivery, can cut that category by 10–20% over a few months. Physical cues help overcome the “out of sight, out of mind” problem that comes with cards and contactless payments. Combine analog tools with digital ones: for example, envelopes for fun money plus an app for everything else, so your impulses meet a visible limit before your card does.

—

Step‑by‑Step Process Using Behavioral Insights

Step 1: Make Your Money Visible and Emotional

Start by pulling the last 3 months of transactions into your budgeting app or a spreadsheet. Don’t aim for perfection; you just need broad categories: housing, transport, groceries, eating out, subscriptions, etc. Then add a behavioral twist: next to each category, write how it actually makes you feel—energized, neutral, or drained. Recent surveys between 2022 and 2024 consistently show that people who tie money to values and feelings, not just numbers, are more likely to stick with a plan for 6 months or more. Your first goal isn’t optimization; it’s awareness. You’re turning your spending into a story you can edit, not just a ledger you fear.

Step 2: Design “Good Defaults” Instead of Willpower Tests

Next, set up automatic systems that quietly do the right thing when you’re not paying attention. Route savings and debt payments out of your account the day after income hits, so “spend what’s left” becomes the default. Split your budget into essentials, commitments (like debt and saving) and flexible fun, then cap the fun money. Many people find behavioral money coaching for better budgeting helpful here because a coach pushes you to bake your goals into your bank flows, not into hopeful intentions. Over the last three years, autopay and autosave usage has risen steadily, and users with automation report fewer overdrafts and less money anxiety.

Step 3: Add Friction to Temptations and Rewards to Good Behavior

Humans respond strongly to friction and small rewards, so put them to work. To curb impulse spending, create a 24‑hour rule for online purchases above a certain amount and remove stored card details from major shopping sites. That tiny bit of hassle makes “later” more likely. On the reward side, schedule a short weekly money date: 10–15 minutes to review categories, move leftovers into savings and consciously celebrate wins, even if it’s just “no food delivery on weekdays.” Research from the last few years shows that short, recurring check‑ins beat occasional marathon budgeting sessions when it comes to long‑term consistency and lower stress.

—

Troubleshooting Common Budgeting Problems

“I Keep Falling Off After a Few Weeks”

If you start strong and then disappear, you don’t have a discipline problem; you have a design problem. Shrink your system until it’s nearly impossible to skip. Instead of tracking 25 categories, start with three: fixed bills, savings/debt, and everything else. Use your app’s simplest view and ignore the rest. Many people who struggle with consistency find that using fewer features of their behavioral finance budgeting tools actually increases adherence. Another trick: tie your money check‑in to an existing habit—Saturday coffee, Sunday planning, or your payday evening. The goal is to make budgeting “the thing you do before X,” not a huge separate task.

“Emergencies Keep Blowing Up My Plan”

The last few years have made it obvious that life throws curveballs; surveys from 2022–2024 show that unexpected expenses remain one of the top reasons people abandon their budgets. The fix is to stop treating emergencies as rare and start budgeting for them as a permanent category. Build a modest starter emergency fund first—say, one month of critical bills—before aggressive debt payoff or investing. Label this fund clearly in your app so you see its purpose, not just its number. When a true emergency hits, you use that fund guilt‑free, then rebuild it. This reframes disruptions from “budget failure” to “budget doing its job,” which keeps motivation intact.

“I Know What to Do, but I Still Don’t Do It”

When knowledge isn’t the issue, focus on accountability and identity. Ask: who else is involved in my money decisions, and how often do we talk? Couples who hold regular, short money conversations report better adherence than those who only talk in crises. If you’re solo, consider a friend with similar goals, an online community, or a professional. A financial planning service with behavioral coaching can be particularly effective if your income is decent but your follow‑through is weak, because someone helps you translate insight into action. Over the last three years, more services have added behavioral checkpoints—nudges, reminders, and progress reviews—so you don’t rely solely on willpower.