Why Your Budget Keeps Failing (And What To Do Differently Today)

Let’s be honest: most people don’t have a “money problem” — they have a “budgeting system” problem.

You download a template, swear this is the month you’ll change everything… and three weeks later your card is smoking again, you’re confused where the cash went, and the spreadsheet hasn’t been opened since day 4.

That’s not laziness. It’s usually a handful of silent budgeting mistakes that make the whole thing impossible to stick to.

Let’s break down the most common budgeting mistakes to avoid — and, more importantly, how to fix them in ways that a normal, busy human can actually maintain.

—

Mistake #1: Budgeting for a Fantasy Life, Not Your Real One

Most budgets die before they’re even born, because they’re built for an ideal version of you:

– The you who never eats out

– The you who always cooks from scratch

– The you who never forgets a birthday, bill, or subscription

Real life doesn’t look like that.

You plan to spend $120 on groceries… but your real average is $280. You decide “No eating out this month”… but you’ve eaten out 8–10 times every month for the last year.

That’s not discipline. That’s data.

Real-World Example

Anna, 29, tried budgeting three times. Each time she:

– Slashed “Dining Out” to $0

– Cut “Shopping” by 70%

– Ignored annual expenses like car insurance

By week two she’d blown her “perfect” budget, felt guilty, and gave up.

Once she pulled 3 months of bank statements, a pattern appeared:

– Dining out: actually $260/month on average

– Groceries: $320/month

– “Random” gifts / subscriptions: $80–100/month

We rebuilt her plan around her *real* numbers and then trimmed by 10–15%, not 70–100%. Suddenly the budget stopped fighting her.

—

> Technical Block: How to Base Your Budget on Reality (Not Hope)

> 1. Export the last 90 days of transactions from your bank/credit cards.

> 2. Sort into simple categories: housing, utilities, groceries, transport, eating out, fun, debt, savings, “other”.

> 3. Add totals for each category and divide by 3 to get a monthly average.

> 4. For each category, cut by a *realistic* margin:

> – 5–10% cut if you’ve been overspending for years

> – Up to 15–20% if it’s a short-term push (e.g., saving for a move)

> 5. Build your budget from these adjusted numbers, not guesses.

—

Mistake #2: Only Budgeting Once a Month

A monthly budget that you look at once is just a wish list.

Most people set up their personal budget planner to stop overspending on the 1st, then live the rest of the month by vibes and card swipes.

By the time you “check in” again, the damage is done.

Make It a 10-Minute Weekly Habit

Instead of obsessing daily, a simple weekly money check-in works far better:

– 10 minutes

– Same day each week

– Same basic questions

Ask:

1. How much have I spent in each main category so far?

2. Do I need to slow down in any category this week?

3. Are there any one-off expenses coming up (gifts, repairs, trips)?

You’re not punishing yourself — you’re steering the ship before it hits a rock.

—

> Technical Block: A Simple Weekly Budget Check Template

> – Open your budgeting app or spreadsheet.

> – Note current spend vs. target in 3–5 key categories (e.g., groceries, dining out, transport, fun, “random”).

> – Use a traffic-light code:

> – Green: under 50% of monthly budget and over halfway through the month → you’re good.

> – Yellow: 50–80% of the budget with more than half the month left → take it easy.

> – Red: over 80% before the last week → pause spending in that category if possible.

> – Adjust this week’s behavior (more cooking at home, skip one outing, delay a purchase) instead of waiting until next month.

—

Mistake #3: Forgetting the “Non-Monthly” Bills

One of the sneakiest budgeting mistakes to avoid: pretending irregular bills are “surprises.”

They’re not.

– Car insurance every 6 or 12 months

– Annual subscriptions (software, streaming, gym)

– Holiday gifts

– Car maintenance

– Medical co-pays or annual checkups

They don’t show up monthly, so your budget looks perfect… until a $600 insurance bill nukes your progress.

Turn Yearly Costs Into Monthly Lines

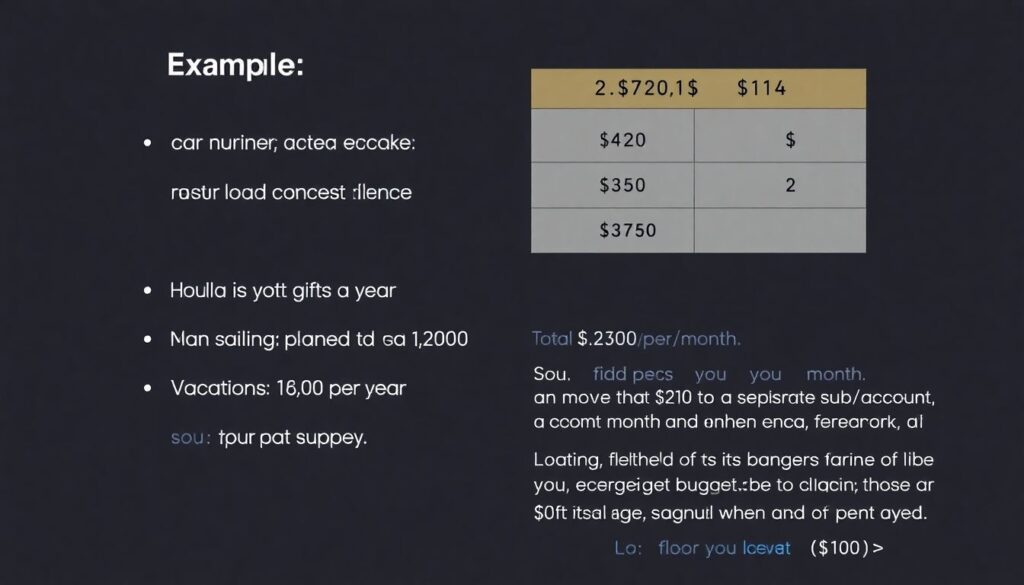

Example:

– Car insurance: $720 once a year

– Holiday gifts: $600 a year

– Vacations: $1,200 planned for the year

Total: $2,520 per year → $210 per month.

So in your budget, you set:

– “Annual Bills & Holidays” = $210/month

You move that $210 to a separate savings sub-account every month. When those bills hit, the money’s already waiting.

—

> Technical Block: Quick Formula for Irregular Expenses

> 1. List all non-monthly expenses with their amounts.

> 2. Add up the total annual cost.

> 3. Divide by 12 to get the monthly amount to set aside.

> 4. Automate a transfer on payday to a separate “Annual & Irregular” savings bucket.

>

> Example: $1,800 total per year ÷ 12 = $150/month auto-transfer.

—

Mistake #4: Tracking “After the Fact” Instead of Before You Spend

Many people think they’re budgeting, but they’re really just doing historical tracking:

– They check their statement at the end of the month

– Categorize everything

– Feel bad

– Change nothing

That’s accounting, not budgeting.

A working budget guides decisions *before* money leaves your account.

Use Apps to See the Damage in Real Time

This is where the best budgeting apps to control spending really earn their keep. When you can see:

– “Dining Out: $180 / $250”

– “Fun: $40 / $100”

*before* you tap your card at the bar, it changes your behavior.

You don’t need a perfect system. You need:

– Real-time view of category balances

– Simple interface

– Notifications when a category is close to its limit

That’s enough to turn “I hope this is fine” into “Actually, I’ll just get one drink.”

—

Mistake #5: Ignoring Your Personality

People fall into three broad “budget personalities”:

1. Spreadsheet Lovers – enjoy details and manual tracking

2. App People – need automation and friendly visuals

3. Envelope / Bucket Types – like physical or digital “pots” of money

A huge, under-rated budgeting mistake is forcing yourself into a system that doesn’t match how your brain works. If you hate spreadsheets, you won’t magically become a spreadsheet person because you “should.”

Match System to Personality

– If you’re visual and busy → app with clear category bars and alerts

– If you’re tactile → cash envelopes or multiple bank sub-accounts

– If you’re analytical → custom spreadsheet with formulas and charts

This is where even light financial coaching to improve budgeting can help: a coach observes your actual behavior and helps you pick a system you’ll realistically use, not just admire on Pinterest.

—

> Technical Block: Minimum Viable Budget System by Type

> – App Type:

> – Choose 5–8 main categories.

> – Set monthly caps.

> – Turn on push alerts for when a category hits 80% used.

> – Spreadsheet Lover:

> – Use income – fixed costs – savings – flexible spending = $0 framework.

> – Track transactions twice a week, not daily.

> – Envelope/Bucket Type:

> – Create separate accounts or cash envelopes for: Groceries, Transport, Fun, Annual Bills.

> – When an envelope/ bucket is empty, spending in that category stops.

—

Mistake #6: No Clear “Job” for Every Dollar

Many budgets say, “I’ll try to save what’s left over.”

That’s how nothing gets saved.

A solid budget assigns a job to *every* dollar on day one:

– Rent

– Food

– Debt

– Savings

– Fun

– Future goals

This is essentially a “zero-based” approach: income – expenses – savings = 0. Every unit of currency is told where to go.

Example: Giving Every Dollar a Job

Say you take home $3,000 per month.

Instead of “I’ll just see what’s left,” you map it:

– Rent & utilities: $1,250

– Groceries: $320

– Transport: $180

– Debt payments: $300

– Annual / irregular fund: $150

– Fun & eating out: $250

– Emergency fund: $250

– Long-term savings / investing: $300

Total: $3,000. No strays.

Suddenly, saying yes to something means saying no to something else you’ve already named. That’s where discipline becomes easier: you’re protecting your own plan, not someone else’s rules.

—

Mistake #7: Trying to Fix Everything at Once

Many people attack their budget like a crash diet:

– “No coffee out.”

– “No eating out at all.”

– “No entertainment.”

– “Save 40% of my income.”

For 5–10 days, willpower carries you. Then life happens.

Effective, long-term budgeting isn’t about aggressive sprints; it’s about modest, permanent upgrades.

The 1–2 Category Rule

Focus on changing *one or two* categories at a time, not your whole life.

For example:

– Month 1–2: Reduce eating out by 20–25%

– Month 3–4: Add $50/month extra to debt payments

– Month 5–6: Build a $500 starter emergency fund

That might sound slow, but notice what happens over a year: small changes compound into very real progress.

—

> Technical Block: How to Fix Budgeting Mistakes Step-by-Step

> 1. Identify your top two leak categories (usually dining out, groceries, or “random stuff”).

> 2. Pull your 3‑month average for each.

> 3. Set a new limit at 80–90% of that average, not 50%.

> 4. Add an automatic transfer for savings or debt with the difference.

> 5. Run this for 2 full months before making any more cuts.

—

Mistake #8: No Friction Between You and Impulse Spending

Modern payment systems make overspending ridiculously easy:

– One-click buying

– Saved cards everywhere

– Contactless taps

A personal budget planner to stop overspending isn’t just numbers — it’s also about adding just enough friction that you have time to think before you buy.

Practical Friction You Can Add Today

– Remove stored cards from shopping sites

– Turn off 1‑click purchase

– Use a separate “spending” card with a capped amount for fun

– Wait 24 hours before buying anything over a set threshold (e.g., $50 or $100)

None of this costs money. It simply gives your rational brain a chance to catch up with your feelings.

—

Mistake #9: Doing It All Alone, in Your Head

Money is emotional. It’s very hard to be objective about your own habits.

Two people with the same income and expenses can have completely different results purely because one has support and structure.

This doesn’t always mean paying thousands for help. It can be:

– A friend who does a monthly “money check-in” with you

– A budgeting community or online group

– Or more formally, 1:1 financial coaching to improve budgeting with someone who helps you design a system and holds you accountable

When you talk your plan out loud, you’re far more likely to actually follow it.

—

Pulling It Together: Build a Budget You’ll Actually Use

To recap the core budgeting mistakes to break today and what to do instead:

– Stop guessing: base your categories on the last 3 months of real spending

– Stop budgeting once a month: add a 10-minute weekly check-in

– Stop ignoring irregular bills: turn yearly costs into monthly savings lines

– Stop tracking only after the fact: use tools that show category balances *before* you spend

– Stop fighting your personality: pick methods (apps, envelopes, spreadsheets) that fit you

– Stop leaving money “jobless”: give every dollar a specific purpose on day one

– Stop crash-diet budgeting: improve 1–2 categories at a time, then layer on

If you do nothing else today, do this:

1. Pull the last 90 days of transactions.

2. Find your average in three categories: groceries, dining out, “random stuff.”

3. Set next month’s targets at 90% of those averages.

4. Redirect the 10% difference toward savings or debt *automatically*.

That one small sequence — repeated — will beat any perfect budget you never stick to.