Understanding Cost of Ownership in Practice

Why cost of ownership matters today

When companies ask what is total cost of ownership in business, they’re really asking: “What will this decision cost me over the whole lifecycle, not just on day one?” Modern firms discovered the hard way that cheap purchases can turn into expensive mistakes. According to a 2023 McKinsey review, organizations that systematically track lifecycle costs cut their operating expenses on key assets by 10–15% within three years. Since 2022, rising energy prices and service rates have pushed many CFOs to revisit how they buy software, vehicles and industrial equipment, shifting focus from discounts to long‑term efficiency and resilience.

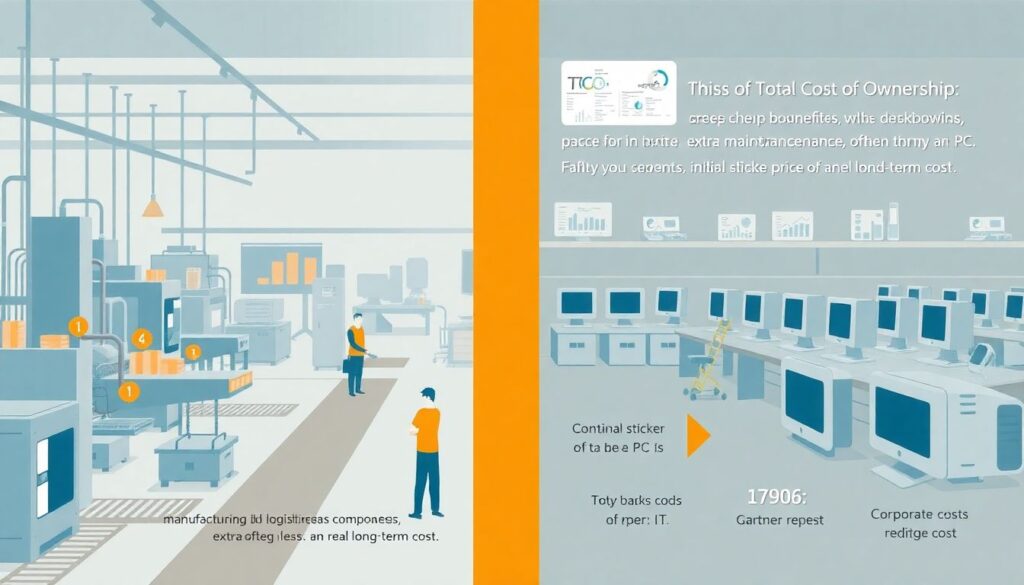

Historical background: from purchase price to lifecycle thinking

The idea of total cost of ownership (TCO) started gaining traction in the 1980s in manufacturing and logistics, when firms noticed that “bargain” components triggered extra downtime and maintenance. In the 1990s Gartner popularized TCO for IT, showing that the sticker price of a PC was often less than 20% of its real cost once support, training and outages were added. Over the last three years this mindset has spread beyond IT: a 2022 Deloitte survey reported that over 60% of large companies include lifecycle costs in capex approvals, compared with roughly 45% in 2019, and the trend has only strengthened with inflation and supply‑chain risks.

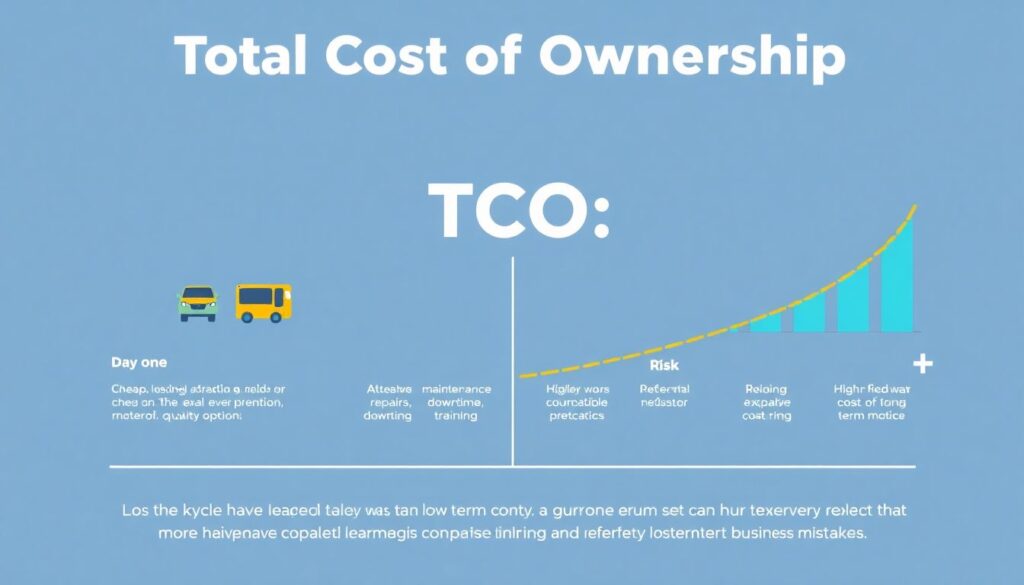

Basic principles: what actually goes into TCO

Think of cost of ownership as every dollar tied to owning, running and eventually disposing of an asset. To avoid confusion between total cost of ownership vs purchase price, imagine the invoice as just the “entry ticket,” while TCO is the entire cost of the ride. A practical breakdown usually includes acquisition, operation, maintenance, downtime, training and end‑of‑life. Over 2022–2023, research by various consulting firms consistently showed that for long‑lived assets like trucks or CNC machines, operating costs over 5–7 years can reach 2–4 times the original purchase price, which is exactly why TCO is no longer a theory but a budgeting necessity.

- Acquisition: price, taxes, delivery, installation, customization.

- Operation: energy, consumables, software licenses, staffing.

- Maintenance: repairs, spare parts, service contracts, upgrades.

- Risk: downtime, quality issues, compliance penalties, cyber incidents.

- End‑of‑life: decommissioning, disposal, resale, data wiping.

How to calculate TCO for real equipment

Many managers quietly google how to calculate total cost of ownership for equipment, hoping for a magic formula. In practice you forecast cash flows over the asset’s life, then sum or discount them. A simple total cost of ownership calculator in a spreadsheet can handle this: list all yearly costs, decide on a time horizon (say, 7 years) and apply a discount rate that reflects your cost of capital. Studies between 2021 and 2023 show that even this basic approach helps manufacturing firms uncover 8–12% “hidden” costs, mostly from unplanned downtime and inefficient energy use, which were invisible when they only compared offers by upfront price.

- Start from usage assumptions: hours per year, production volume, load.

- Add realistic failure rates, repair times and spare parts prices.

- Include training, software, connectivity and cybersecurity where relevant.

- Estimate residual value or disposal costs at the end of life.

- Run best‑case and worst‑case scenarios to see sensitivity.

Using services and tools instead of doing it all by hand

Not every company has analysts on standby, so many rely on vendor tools and independent total cost of ownership analysis services. Cloud providers, for example, offer calculators comparing on‑premise servers and cloud workloads; Gartner and IDC publish benchmarks by industry. Between 2022 and 2024, adoption of such tools in mid‑sized firms grew steadily: IDC reported around 30% of mid‑market IT buyers used formal TCO assessments in 2021, rising to around 45% by 2023. The key is to treat vendor calculators as a starting point, then adjust inputs to reflect your own salaries, energy tariffs, reliability requirements and regulatory context.

Concrete examples: IT, vehicles and manufacturing

In IT, a typical case is comparing on‑prem servers with cloud. A European retailer that ran a TCO comparison in 2022 discovered that while on‑prem hardware seemed 20% cheaper on purchase price, once they added power, cooling, admin time and upgrade cycles, cloud was about 15% cheaper over five years. In fleet management, logistics companies that analyzed TCO for electric vs diesel vans in 2022–2023 often found EVs had 10–20% higher upfront cost but 25–40% lower fuel and maintenance costs, making them cheaper overall within 4–6 years, especially in regions with subsidies and high fuel prices.

- IT: servers, laptops, SaaS vs on‑prem software, network gear.

- Transport: trucks, delivery vans, company cars, forklifts.

- Production: presses, robots, 3D printers, HVAC and compressors.

- Facilities: lighting, building automation, security systems.

Common misconceptions and mental traps

Several myths still derail TCO thinking. One is “we’ll fix it later”: teams focus on getting budget approval and ignore operating costs, assuming they belong to another department. Another is confusing aggressive discounts with savings; if a machine requires expensive proprietary consumables, the total cost of ownership vs purchase price gap explodes within a couple of years. A 2023 survey by a major ERP vendor found that over half of respondents underestimated training and change‑management costs by at least 30%, which explains why many digital projects run over budget even though license prices look manageable on paper.

Key statistics and trends from the last three years

Based on data available up to late 2023, several patterns are clear. A 2022 PwC report indicated that firms using structured TCO methods achieved average lifecycle cost reductions of around 8% on new capital projects. Gartner noted that organizations integrating TCO into IT procurement cut unplanned downtime by roughly 20% between 2020 and 2023, mainly through better maintenance and support contracts. For 2024–2025, analysts project further growth in TCO adoption, especially in energy‑intensive industries, but precise post‑2023 numbers are not yet fully validated and should be treated as early estimates rather than confirmed statistics.

How to start applying TCO thinking tomorrow

You don’t need a PhD in finance to begin. Pick an upcoming purchase with significant operating costs—say, a new line‑of‑business app or a piece of workshop equipment—and model three to five years of expenses. Use a simple total cost of ownership calculator and sanity‑check your assumptions with people who will actually run and maintain the asset. If it feels overwhelming, start small: compare two alternative suppliers using a lightweight TCO model. Over a few cycles, you’ll build a library of real numbers and, more importantly, a culture where teams ask “what will this cost us over its life?” instead of “how big is the discount today?”.