From Pensions to “What’s My Number?”: Why This Question Matters in 2025

In your grandparents’ era the answer to “how much do I need to retire?” was simple: work 40 years, get a pension, add Social Security, done. Since the 1980s the risk quietly shifted from employers to individuals. Defined‑benefit pensions shrank, 401(k) plans exploded, and markets became the main source of retirement income. Fast‑forward to 2025: people live longer, careers are less linear, and housing and healthcare costs bite harder. No wonder “how much money do I need to retire comfortably” feels less like math and more like fortune‑telling. The good news: a few grounded rules of thumb can turn the fog into a roadmap.

A Simple Framework for Setting Your Retirement Number

Core Idea: Convert Lifestyle into a Target Portfolio

Instead of chasing a magic lump sum from the internet, start with lifestyle. A practical framework has four steps:

1. Estimate your future annual spending.

2. Subtract reliable income (pensions, Social Security, rentals).

3. Convert the remaining gap into a portfolio size using a safe withdrawal rate.

4. Stress‑test with different scenarios.

This shifts the question from “What does a retirement calculator how much do I need say?” to “What does *my* life actually cost?” The math is simple; the real work is being honest about what you’ll spend and what you’ll compromise on.

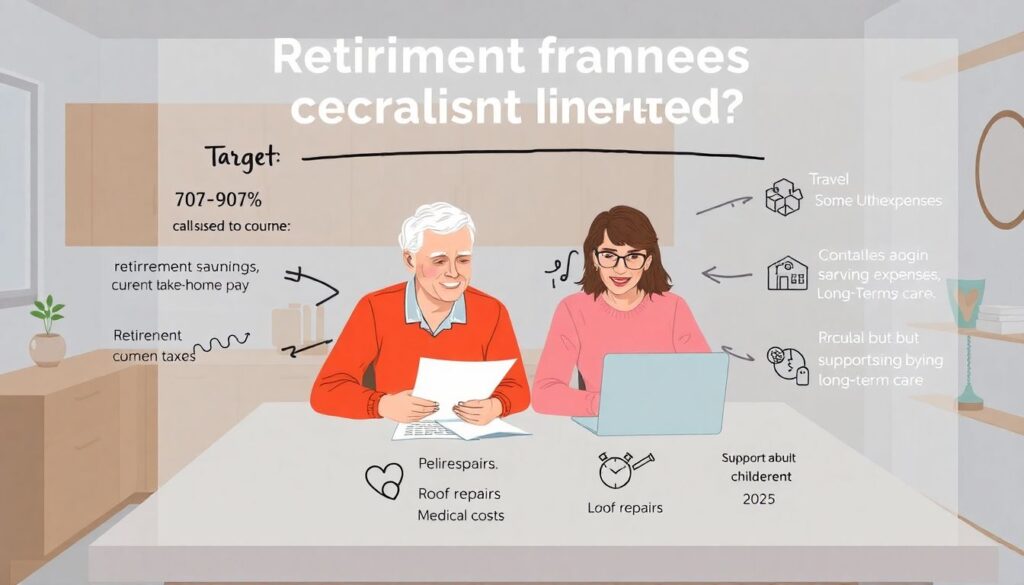

Step 1: Estimating Future Spending Without Lying to Yourself

A useful starting point is 70–90% of your current take‑home pay, adjusting for what disappears (commuting, retirement savings, some taxes) and what grows (travel, hobbies, medical costs). Don’t forget irregular but painful items: roof repairs, supporting adult children, long‑term care. In 2025 health insurance and housing inflation outpace general inflation in many countries, so underestimating here is the biggest trap. Build in a discomfort buffer: add 10–15% to whatever “feels” right. It’s better to over‑save on paper than to improvise at 78 when markets are down and work isn’t an option.

Step 2–3: From Income Gap to “Your Number”

Now list relatively stable income sources: government benefits, any pension, annuities, perhaps part‑time work. Subtract this from your spending estimate: that shortfall is what your investments must cover each year. To turn that gap into a target portfolio, many planners still lean on a version of the 4% rule: in very rough terms, each $1 you need yearly requires about $25 in invested assets. In a low‑yield, volatile world, a more cautious 3–3.5% withdrawal can be sensible, especially if you’re retiring early. The smaller the percentage you withdraw each year, the larger “your number” must be, but the more resilient your plan.

Comparing Popular Approaches to “Your Number”

Three Main Schools: Rule‑of‑Thumb, Detailed Planning, and FIRE

Broadly, you’ll see three approaches.

1. Rules of thumb: “Save 10–15× your salary,” “withdraw 4%.” Fast and motivating, but they ignore personal nuance.

2. Comprehensive planning: Cash‑flow projections, tax modeling, Monte Carlo simulations. More accurate, but slower and dependent on assumptions.

3. FIRE style: aggressive saving, lean spending, and very early retirement, often assuming a 3–3.5% withdrawal. Inspiring, but heavily exposed to market and lifestyle risk.

In practice many people blend these: start with a rule of thumb, refine with better tools, and then adjust behavior in light of real‑world feedback and values.

How Technology Changed Retirement Planning

In the 1990s you needed spreadsheets or a planner; now you can open an app, plug in age, savings, and see colorful charts. Today’s tools range from simple web widgets to AI‑driven simulators and full‑service platforms. They integrate market data, longevity stats, and tax rules and can run thousands of scenarios in seconds. Robo‑advisors automatically rebalance portfolios and harvest tax losses. The upside is accessibility: for many, the best retirement investment accounts for 401k and IRA now come with embedded advice engines by default, lowering barriers. The downside: glossy interfaces can give a false sense of certainty and tempt you to tweak plans based on headlines rather than long‑term strategy.

Pros and Cons of Key Tools and Services

Online Calculators, Robo‑Advisors, Human Planners

Each option has strengths and blind spots:

1. Online calculators

Quick, free, great for orientation and “what if” games. But they often hide assumptions about returns, inflation, and longevity. Typing “retirement calculator how much do I need” into a search bar is a starting point, not a verdict on your future.

2. Robo‑advisors and apps

Low cost, disciplined, emotion‑free rebalancing, often nudging you into diversified portfolios. However, they rarely know your full tax picture, family dynamics, or business interests. Edge cases confuse them.

3. Human advisers

A good financial advisor for retirement planning costs real money, but can coordinate taxes, estate planning, insurance, and behavior coaching. The risk: conflicts of interest (commission‑driven products) and big quality differences between advisers, which means you must vet credentials and compensation models carefully.

How to Choose the Right Mix for You

Practical Recommendations for 2025

For most people in 2025 the sweet spot is layered support. Start by maxing easy wins at work: employer matches and default funds inside the best retirement investment accounts for 401k and IRA options you have. Use a few independent calculators to see a range of outcomes instead of trusting only one. Then, if your situation involves business equity, multiple properties, or complex taxes, search “retirement planning services near me” and interview at least two firms, asking exactly how they’re paid. Finally, decide how much you want to DIY. If you enjoy learning, you can handle the basics and bring in specialists only for high‑stakes decisions.

Trends Shaping Retirement in 2025 and Beyond

Longer Lives, Flexible Work, and Smarter Tools

Three big currents are redefining retirement. First, longevity: a healthy 60‑year‑old in 2025 might live into their 90s, which stretches the withdrawal phase and makes sequence‑of‑returns risk more dangerous. Second, flexible work: many people aren’t stopping at 65 but dialing down, using part‑time or remote work as a risk reducer and identity anchor. Third, tech: AI‑assisted planning, personalized investment portfolios, and real‑time spending analytics are merging into everyday banking apps. The result is less “one‑day cliff retirement” and more fluid transitions, where your “number” becomes a moving, revisited target instead of a single, rigid milestone.