Why Home Insurance Budgeting Suddenly Matters So Much

If your home insurance bill has been creeping up every year, you’re not imagining it. In the U.S., average homeowners premiums have jumped sharply over the last three years as rebuilding costs, weather disasters, and reinsurance prices all climbed.

To put real numbers on it (nationwide estimates, all companies, all dwelling types):

– From 2021 to 2022, the average annual premium rose about 7–9%.

– From 2022 to 2023, increases accelerated to roughly 10–12% in many states.

– Early data for 2024 (through mid‑year) shows another 8–15% on average, with disaster‑prone states (Florida, Louisiana, California, Colorado) often above that range.

When you compound those jumps, many households are paying 25–35% more for the same (or even reduced) coverage than they were three years ago. That’s why “set it and forget it” no longer works. You need an actual insurance budget for your home, not just blind auto‑pay.

Below is a practical, conversational walkthrough so you can plan, control, and defend what you spend on home insurance instead of being surprised every renewal.

—

H2: The Core Goal of Home Insurance Budgeting

Home insurance budgeting is simply answering three questions, in numbers, not vibes:

1. How much coverage do I really need to avoid financial disaster?

2. How much can I realistically afford without blowing my household budget?

3. How do I bridge the gap between those two using smart shopping and risk management?

Over the last three years, many people have solved that “gap” problem the wrong way: by quietly raising deductibles or stripping coverage just to keep premiums near what they used to pay. That can be dangerous when a large loss hits.

A better approach is to treat insurance like any other major expense: analyze it, compare it, and adjust deliberately.

—

H2: Necessary Tools for Smart Home Insurance Budgeting

You don’t need anything fancy, but a few specific tools make this process much less painful.

H3: Digital Tools You’ll Actually Use

Have these ready before you start:

– Budgeting app or spreadsheet

Any basic app (YNAB, EveryDollar, Mint alternatives) or a homemade Google Sheets/Excel file works. You just need a place to plug in premiums, deductibles, and savings targets.

– Homeowners insurance cost calculator

Use at least one reputable online homeowners insurance cost calculator to estimate what your coverage *should* roughly cost in your area, given your home’s size, construction type, and location. This gives you a reality check before you react to your renewal.

– Multiple insurer portals

Create logins with a few of the best home insurance companies in your state and at least one independent comparison site. These help you collect home insurance quotes quickly instead of filling out the same form ten times.

Short version: a spreadsheet, a calculator, and a way to get quotes. That’s your basic toolkit.

H3: Data You Need From Your Own Life

The tools are useless without your own numbers. Gather this once; you’ll reuse it every year.

– Current policy declarations page (coverage limits, deductibles, endorsements)

– Last 12 months of premium payments (monthly or annual)

– Rough rebuild cost per square foot (from your insurer, builder, or a local contractor)

– Claim history for the last 5 years

– Household income and monthly budget basics

Even if you just eyeball these, you’ll make better decisions than 90% of homeowners who never look at the details.

—

H2: Step‑by‑Step Process to Build a Home Insurance Budget

Let’s walk through a structured flow you can reuse every year.

H3: Step 1 – Map Your Current Risk and Coverage

Start by decoding what you already have.

Look at the dwelling coverage (Coverage A) on your policy. This is the amount insurer says it would cost to rebuild your home. Between 2022 and 2024, construction inflation in many U.S. markets ran in the 6–10% per year range, so if your coverage limit hasn’t moved much, there’s a real chance you’re underinsured.

Ask yourself:

– Would my current limit realistically rebuild my home at today’s labor and materials prices?

– Are my other structures, personal property, and loss of use limits still realistic?

If you’re not sure, ask your agent for a fresh replacement‑cost estimate or use that homeowners insurance cost calculator to get a ballpark and see if your current limit looks low.

Short check: if your home value or local build costs jumped over the last three years and your coverage hasn’t kept pace, that’s a red flag.

H3: Step 2 – Quantify What You Can Afford to Lose

Now we talk deductibles and reserves. Your deductible is the amount you’re willing to absorb before insurance kicks in.

Do this quick exercise:

– Look at your emergency fund.

– Decide how much of that you’re willing to risk for a home claim without wrecking your finances.

– Set your deductible *below* that number, not equal to it, so you’re not wiping out savings on a bad day.

Raising your deductible usually lowers premiums. In the last three years, many carriers have nudged customers from $500 toward $1,000, $2,500, or even percentage‑based deductibles (e.g., 1–2% of dwelling coverage) to keep prices somewhat manageable.

You just want to make sure that if a pipe bursts or a small roof claim appears, the deductible doesn’t force you into credit‑card debt.

H3: Step 3 – Define a Target Annual Insurance Budget

Now we tie it into your life.

Look at your total net income. Decide what share of it can reasonably go to homeowners insurance within your overall housing costs (mortgage, taxes, utilities). Many households try to keep home insurance at roughly 1–2% of household income, but the reality in high‑risk states is that this ratio has crept higher since 2022.

Create a specific line item in your budget:

– Primary home insurance premium

– Flood insurance (if separate)

– Earthquake or windstorm policy (where applicable)

Total this out per year and per month. That number is now your “target” when you go shopping. If your quotes are wildly above it, you know you need to adjust coverage, shop harder, or both.

H3: Step 4 – Shop Smart: Compare, Don’t Panic

Now you’re ready to compare home insurance rates instead of just begging your current carrier for mercy.

When you collect home insurance quotes:

– Keep coverage limits and deductibles *as similar as possible* across companies so you’re comparing like‑for‑like.

– Note whether quotes are replacement cost or actual cash value for your dwelling and personal property.

– Check what perils (risks) are excluded or limited; fire and wind might be standard, while flood and earthquake usually need separate policies.

Use at least:

– One or two large, national carriers

– One or two regional or mutual insurers

– An independent agent or comparison site

This mix matters because in the last three years some big brands have pulled back from high‑risk zip codes, while smaller regional companies quietly became the only realistic option.

H3: Step 5 – Optimize Coverage, Not Just Price

Once you’ve seen the spread, it’s tempting to chase the lowest number. Instead, think in terms of value per dollar.

You’re looking for cheap home insurance coverage that still protects you from ruin, not a bargain that only looks good until something big happens.

Pay extra attention to:

– Liability limits (often cheap to increase, critical for protecting assets)

– Extended or guaranteed replacement cost options

– Water backup, ordinance or law, and other key endorsements for older homes

Sketch a quick “shortlist” of 2–3 offers that balance cost and coverage. These are your serious contenders.

—

H2: Section – Using Budgeting Levers: Where You Can Actually Save

Not all cuts are equal. Some save a lot with limited added risk; others barely save anything and add major exposure.

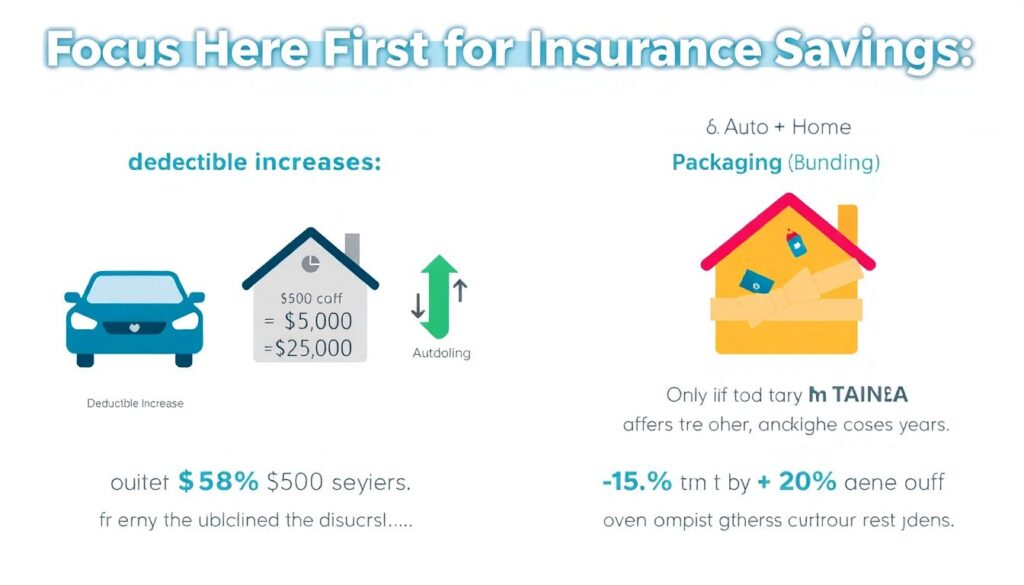

H3: High‑Impact Savings Levers

Focus here first:

– Deductible increases

Moving from $500 to $1,000 or $1,000 to $2,500 can yield noticeable savings, especially over several years, as long as you truly can afford the deductible.

– Packaging (bundling)

Over the past three years, bundling auto + home has often shaved 5–20% off combined premium totals, though actual savings vary by state and carrier.

– Risk‑mitigation discounts

Roof upgrades, impact‑resistant shingles, monitored alarms, leak detectors, and wind mitigation features can unlock permanent premium reductions, particularly in storm‑prone regions.

H3: Low‑Value or Risky “Savings”

Use more caution with these:

– Slashing personal property limits far below what you own

– Dropping replacement cost on contents and accepting actual cash value

– Accepting major exclusions (e.g., named‑peril only) without understanding them

Short rule: if a change might leave you unable to rebuild or replace core necessities after a serious loss, don’t make that change just to hit this year’s budget.

—

H2: Tracking the Numbers Year by Year

Home insurance isn’t a “do this once and you’re done” project anymore. The last three years proved that.

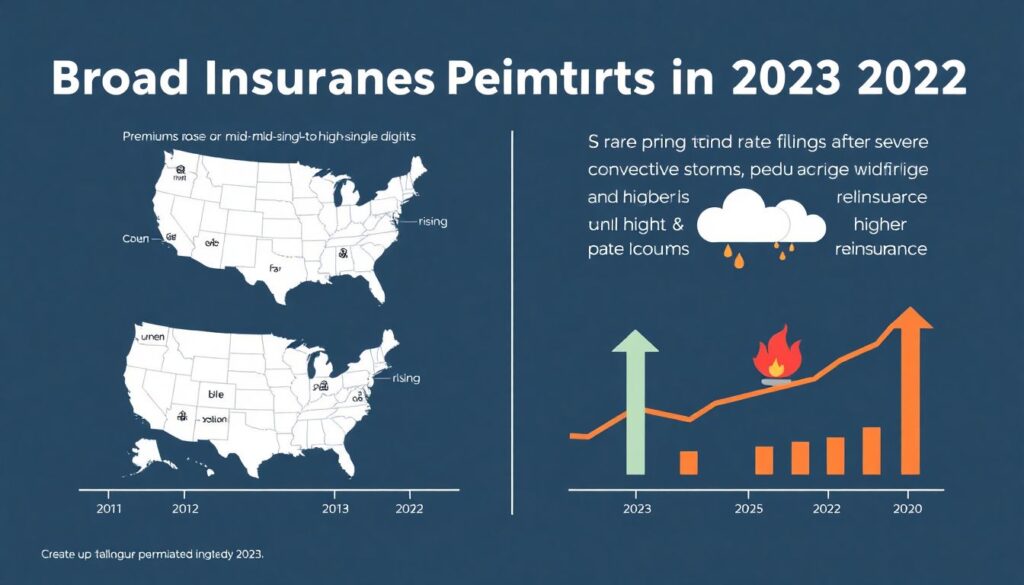

H3: What’s Been Happening 2022–2024

Summarizing broad U.S. trends:

– 2022: Premiums rose mid‑single to high‑single digits, driven mostly by construction inflation and moderate catastrophe losses.

– 2023: Rate filings spiked in many states after severe convective storms, wildfires, and reinsurance hikes; double‑digit increases became common.

– 2024 (through late year): Continued hard market; some states seeing carriers non‑renew properties in high‑risk zones, while average premiums climb another high single to low double digits.

Behind the scenes, reinsurers—companies that insure the insurers—have raised their prices significantly over this period, which flows through to your bill.

H3: Your Personal Tracking Routine

Once a year—ideally 60–90 days before renewal:

– Log into your spreadsheet or app.

– Enter the new proposed premium.

– Compare last 3 years side by side to see your personal trend.

– If the year‑over‑year jump is more than, say, 10–15%, use that as your trigger to re‑shop and re‑check coverage.

This way, you’re not reacting emotionally to a big bill; you’re making data‑driven decisions.

—

H2: Troubleshooting: When Your Home Insurance Budget Blows Up

Sometimes, even with planning, your premium suddenly jumps, your policy gets non‑renewed, or you discover a coverage gap right after a storm. Here’s how to triage those situations.

H3: Problem 1 – Premium Shock at Renewal

You open the renewal notice and see a 30% hike. Now what?

1. Don’t auto‑renew immediately. You usually have several weeks.

2. Ask your insurer for a breakdown of the increase: statewide rate change, claim surcharges, rating‑factor adjustments.

3. Run at least three new home insurance quotes with comparable limits and deductibles.

4. Test deductible scenarios in your spreadsheet: e.g., $1,000 vs. $2,500, and see what saves the most per year without wrecking your risk tolerance.

If you’re still above your target budget, look at risk‑mitigation investments (roof, mitigation inspections, alarm systems) that can pay back through lower long‑term premiums.

H3: Problem 2 – Non‑Renewal or Carrier Exit

In many high‑risk states, insurers have pulled back or exited in the last three years, leaving homeowners scrambling.

Step‑by‑step:

– Contact your state insurance department website to identify last‑resort or FAIR Plan options if the private market won’t cover you.

– Work with an independent agent who has access to smaller regional carriers you might not find on big comparison sites.

– Temporarily accept a more basic policy if needed just to avoid going uninsured, then refine coverage once the market stabilizes or you find better options.

This is less about budgeting perfection and more about maintaining at least a baseline layer of protection.

H3: Problem 3 – Underinsurance Discovered After a Loss

Unfortunately, a lot of homeowners realized – *after* major storms or fires during the last three years – that their coverage limits were far too low.

If you’re in that situation now:

– Document everything thoroughly (photos, contractor estimates, inventories) to maximize what you can recover under existing limits.

– Consult a public adjuster or attorney if there’s a dispute on scope or valuation.

– Once the claim is settled, immediately update your coverage to reflect the true rebuild cost so you’re not exposed to the same problem again.

For everyone else, treat those stories as a warning and check your limits *before* disaster hits.

—

H2: Putting It All Together

Home insurance budgeting isn’t about chasing the rock‑bottom price. It’s about deliberately choosing:

– The losses you’re prepared to absorb

– The coverage you absolutely must have to avoid financial ruin

– The insurers who offer the best value for the premium

Use your tools—a simple budget, a homeowners insurance cost calculator, and a healthy set of home insurance quotes—to see whether you’re aligned with the market or wildly overpaying. Remember to compare home insurance rates every year or two, and look beyond just the biggest names; some of the best home insurance companies for your situation may be regional carriers with strong financials and good claim practices.

If you do this once and then keep the system updated yearly, you’ll be in the minority of homeowners who actually know what they pay, why they pay it, and how to adjust when the market moves—without panicking or leaving yourself dangerously exposed.