Category: Budgeting Basics

-

Digital wallets and contactless payments: how they impact your budget

What digital wallets really are (and why your budget should care) Digital wallets sound fancy, but in practice they’re just software that stores your payment details and lets you pay without pulling out a physical card or cash. Think Apple Pay, Google Wallet, PayPal, or your bank’s app. Contactless payments are the “tap” part: your…

-

Avoiding common budgeting mistakes in 2025 for better personal finance management

Avoiding Common Budgeting Mistakes in 2025: What Actually Works Now Budgets used to mean a cramped Excel sheet and a headache. Вut 2025 is different. Ген‑AI, open banking, instant subscriptions, BNPL‑сервисы и «тап‑тап — купил» превратили управление деньгами в подвижную цель. Ошибка сегодня — не просто неправильно посчитанная строка, а неверная настройка целой системы: приложений,…

-

Smart budgeting for home-based entrepreneurs to grow profit and stability

Why “Smart” Budgeting Matters More at Home Running a business from home feels lean and flexible… right up until the first tax bill, missed invoice, or surprise software renewal hits your account on the same day as your rent or mortgage. Unlike a classic office-based company, home-based entrepreneurs смешивают: – личные счета (еда, жильё, дети)…

-

Reducing financial anxiety: a practical guide to calmer money decisions

Why Money Anxiety Feels So Overwhelming Financial anxiety isn’t just “being bad with money”; это предсказуемая реакция нервной системы на неопределённость. Когда вы не понимаете, сколько можете потратить, что будет с долгами и как пережить неожиданные расходы, мозг включает режим угрозы. Отсюда бессонница, прокрастинация, импульсивные покупки и навязчивый поиск how to stop worrying about money….

-

Investing in your own education: how to budget smartly for courses

Why treating education like an investment changes everything When you stop воспринимать обучение как расход и начинаете считать его активом, логика денег резко меняется. Потратить $400 на курс кажется дорогим, пока не сравнишь: один удачный переход в более высокооплачиваемую роль поднимает доход, например, на $500 в месяц — это $6 000 в год. Даже если…

-

Smart budgeting for gig economy workers to manage income and save more

Нobody working gigs full‑time needs to be told that money comes in waves. One month you’re drowning in orders, the next you’re refreshing the app and wondering if the algorithm forgot about you. Smart budgeting for gig economy workers — курьеры, водители, фриланс‑дизайнеры, маркетологи, консультанты — по сути превращается в управление риском: как прожить между…

-

Practical guide to saving on groceries in 2025 for smarter everyday shopping

Why Saving on Groceries in 2025 Matters More Than Ever Prices jump, promotions change weekly, иt feels like the rules of the game rewrite themselves overnight. Yet people who освоили how to save money on groceries 2025 показывают, что даже при высокой инфляции реально срезать чек на 20–40%, не переходя на лапшу быстрого приготовления. Главное…

-

Your guide to better money habits in 30 days for smarter saving and spending

Why 30 Days Is Enough to Reset Your Money Habits Spending a month on your finances may sound ambitious, но на практике это управляемый срок, в который можно заметно изменить поведение с деньгами. За 30 дней вы не станете инвест‑гуру, но уверенно поймёте, куда утекают деньги, что с этим делать и как перестать жить от…

-

Financial systems and routines for busy lives to simplify and grow your money

Why Busy People Need Simple Financial Systems, Not More Willpower When жизнь превращается в бесконечный список задач, деньги легко уходят на автопилоте — и не в вашу пользу. Правда в том, что вам не нужно становиться финансовым гением или жить по жесткому аскетичному бюджету. Нужна понятная система, которая работает даже тогда, когда вы устали, в…

-

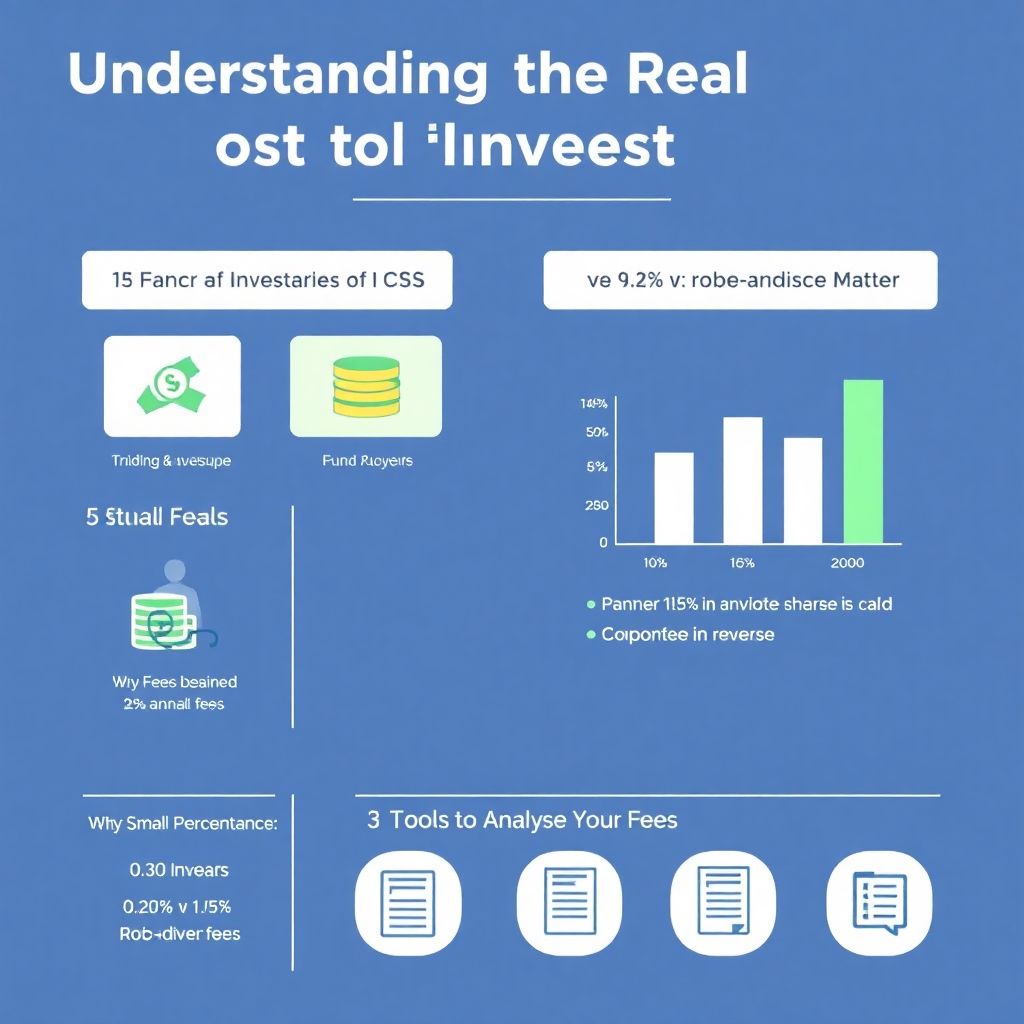

Understanding investment fees: a beginner’s guide to smarter investing

Understanding the Real Cost of Investing What Investment Fees Actually Are When you start investing, the list of charges can feel like alphabet soup: TER, MER, load, spread, custody, advisory. Instead of memorising every term, focus on one idea: every fee takes a slice of your returns, year after year. In practice, fees show up…