Category: Budgeting Basics

-

Retirement income sources explained: understanding your options for retirement

Why Your Retirement Paycheck Will Probably Have Many Moving Parts When people say “retirement income,” they often imagine one neat monthly deposit that just appears forever. In reality, most retirees cobble together a paycheck from several different retirement income sources: Social Security, workplace plans, IRAs, pensions, savings, maybe a rental, maybe part‑time work. Over the…

-

Dealing with financial setbacks: resilience tips to rebuild your money

If the last few years have taught us anything, it’s that even the most careful money plans can get smashed by reality. Layoffs, medical bills, failed businesses, divorce, wars, pandemics, inflation spikes – none of this asks for permission first. Dealing with financial setbacks isn’t just about numbers on a spreadsheet; it’s about your ability…

-

Cost-conscious home design and renovation: smart ways to upgrade on a budget

Why Cost-Conscious Design Beats Constant “Saving Mode” Most people start a renovation thinking only in terms of “how to spend less right now”. Cost‑conscious design работает иначе: вы сначала решаете, за что действительно стоит платить, а где безболезненно сэкономить, чтобы дом был удобным и не развалился через три года. Такой подход помогает выбирать материалы, планировку…

-

Sustainable budgeting for retirees on fixed incomes: practical strategies for stability

Sustainable budgeting: why fixed incomes feel tighter in 2025 Retiring on a fixed income used to feel safer. In the 1980s many workers had predictable pensions indexed to inflation, and prices, though high, eventually calmed down. Fast‑forward to 2025: according to OECD data, people now spend roughly 20–25 years in retirement on average, while medical…

-

Financial planning for parental caregiving: how to balance costs and care

Money and family are always a delicate mix, and nothing tests that quite like stepping into the role of caregiver for your parents. Financial planning for parental caregiving isn’t just about spreadsheets; it’s about protecting their dignity, your sanity, and everyone’s long‑term security. Let’s walk through how to think about it in 2025—practically, historically, and…

-

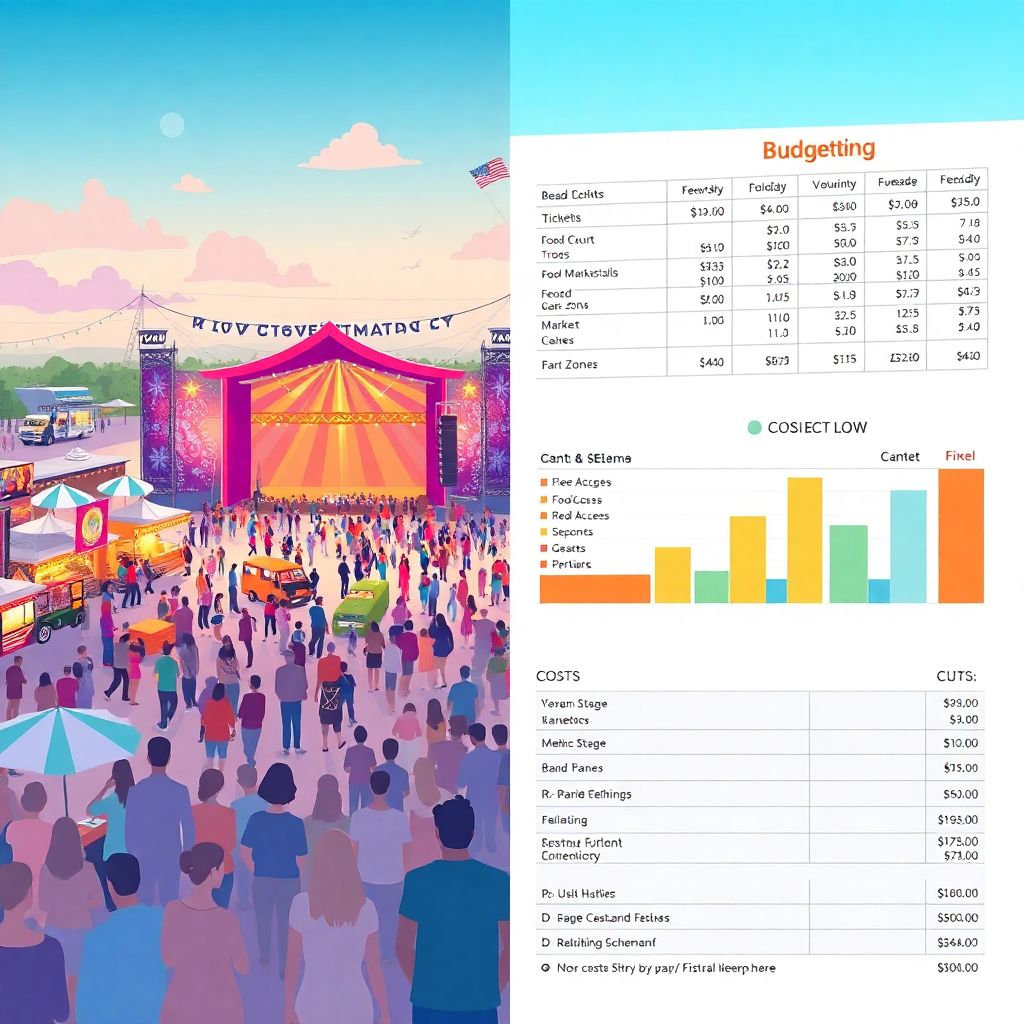

Budgeting for seasonal festivals and events to save more and stress less

Why seasonal festivals quietly live or die on their budget Когда люди говорят о подготовке к фестивалю, все вспоминают про сцену, хедлайнеров, фудкорт и фотозоны. А потом за неделю до старта внезапно выясняется, что денег на уборку территории нет, счет за генераторы выше на 40%, а партнеры платят позже, чем поставщики требуют оплату. Именно здесь…

-

Budgeting for festivals and religious holidays: smart ways to save money

Why festivals blow up our wallets: a quick history tour If you feel festivals are getting more expensive every year, you’re not imagining it. Historically, big religious holidays were often limited by local resources: what you grew, hunted or bartered defined the feast. In many traditions, lavish celebration happened maybe a few times a year,…

-

Life insurance needs calculator for families: how to choose coverage

Understanding a Life Insurance Needs Calculator for Families A life insurance needs calculator for families is essentially a structured formula that translates your financial situation into конкретные цифры страховой суммы. Вместо того чтобы угадывать, how much life insurance do I need for my family, вы вводите исходные данные: доход, долги, расходы на детей, планы по…

-

Auto maintenance tips for safe driving and long lasting vehicle performance

Автомобильный рынок сегодня похож на большой пазл: страховка, покупка, ремонт, кредиты — всё связано, а ошибка в одном месте цепочкой тянет деньги из кармана в других. Ниже разберём реальные кейсы, неочевидные решения и лайфхаки, которые обычно всплывают только в разговорах между практиками, а не в рекламных буклетах дилеров и банков. Стиль будет живой и разговорный,…

-

Insurance budgeting: home cost planning and smart coverage tips

Why Home Insurance Budgeting Suddenly Matters So Much If your home insurance bill has been creeping up every year, you’re not imagining it. In the U.S., average homeowners premiums have jumped sharply over the last three years as rebuilding costs, weather disasters, and reinsurance prices all climbed. To put real numbers on it (nationwide estimates,…