Category: Debt Management

-

How to save for a home internationally and build your budget for buying abroad

Why Saving for a Home Abroad Feels So Tricky Buying жильё в другой стране — это не просто большая покупка, а одновременно финансовый, юридический и культурный квест. Любой international home buying guide честно признает: главная сложность не в поиске красивой квартиры, а в том, как накопить в нужной валюте, защититься от колебаний курсов и не…

-

Investing in education: scholarships and savings plans for your childs future

Why Treat Education Like an Investment, Not Just an Expense When people talk about investing, они обычно вспоминают акции, крипту или недвижимость, но образование часто даёт более предсказуемую «доходность». Диплом не гарантирует лёгкую карьеру, но статистика по-прежнему показывает: выпускники в среднем зарабатывают больше и реже остаются без работы. В 2025 году рынок труда быстро автоматизируется,…

-

Taxes explained: essential guide to understanding and optimizing your tax duties

Why taxes still scare smart people (and why it’s mostly about a few repeatable mistakes) Most people who mess up with taxes не глупые и не безответственные. Они просто заходят в тему с неправильных ожиданий: «я же не миллиардер, что там считать», «онлайн‑сервис сделает всё за меня», «налоговая сама скажет, если что не так». А…

-

Understanding your paycheck duzzles: how taxes and benefits shape your income

Historical background: why paychecks look so confusing If your paycheck looks like a secret code, that’s not an accident. Modern stubs are the result of decades of tax laws, benefit programs, and digital payroll software piling on top of each other. Early in the 20th century, most people were paid in cash, and income taxes…

-

Practical guide to credit card churn and why to avoid this risky strategy

Understanding Credit Card Churn Mechanics Credit card churn — это систематическое открытие и закрытие карт ради бонусов — выглядит как «бесплатные деньги», пока не начинаешь считать издержки. Механика проста: пользователь подаёт заявку, выполняет минимальный расход ради welcome‑бонуса, инкассирует мили или кэшбэк и через несколько месяцев закрывает карту или переводит расходы на следующую. На бумаге стратегия…

-

From paycheck to prosperity: a roadmap to financial freedom and lasting wealth

Why “working harder” isn’t the way out of paycheck‑to‑paycheck Most people who live от зарплаты до зарплаты не ленивы и не безответственны. Они просто застряли в системе, где их деньги запрограммированы исчезать сразу после поступления. Больше часов, подработка по вечерам, тщательная экономия на кофе — всё это даёт лишь временный эффект, если не поменять саму…

-

How to budget for a wedding without debt and plan an affordable celebration

Planning a wedding without taking on debt is absolutely possible, but it does require honesty, structure and a bit of creativity. Below is a practical guide in a conversational tone, grounded in real-life cases, that will walk you through how to budget for a wedding without waking up to credit card nightmares later. Mindset First:…

-

Practical guide to managing online subscriptions and cutting recurring costs

Why online subscriptions feel out of control in 2025 If it feels like half of your life now runs on subscriptions, you’re not imagining things. In 2025, media, fitness, cloud storage, software, learning platforms, even car functions and smart‑home gadgets all quietly bill you every month. Каждая новая регистрация обещает удобство, а в итоге вы…

-

How to protect your loved ones with a simple will and secure their future

Planning what happens after you’re gone isn’t exactly dinner‑table conversation, but a simple will is still one of the most efficient tools to protect the people you care about. In 2025, with online platforms, remote notarization and AI‑driven document checkers, creating a basic, legally sound will is easier than it has ever been—as long as…

-

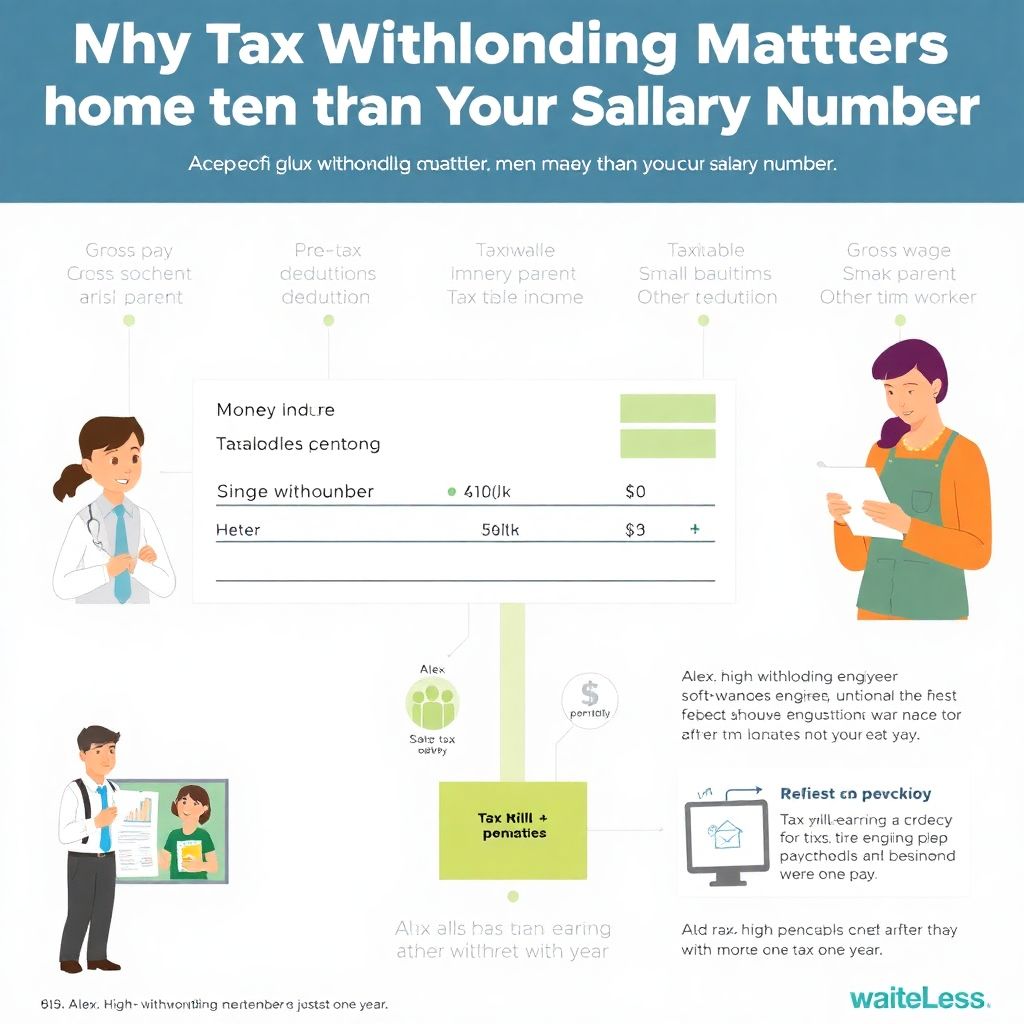

Tax withholding and your paycheck: how it works and what affects your take‑home pay

Why Tax Withholding Matters More Than Your Salary Number When people look at a job offer, they focus on the gross salary and then feel cheated when the first paycheck arrives smaller than expected. The gap is driven by tax withholding: money your employer sends directly to the government on your behalf. It covers federal…