Category: Debt Management

-

Pay off student loans faster with smart strategies to cut debt and save

Why “Smart” Beats “Sacrifice Only” When You’re Crushing Student Loans Paying off student debt isn’t just about skipping lattes and living with three roommates forever. That helps, но это не стратегия. “Smart ways to pay off student loans faster” — это комбинация тактики, цифр и решений, которые реально сдвигают срок полного погашения на годы вперёд,…

-

Finance hacks for students and recent graduates to save money and build wealth

Why Money Feels So Hard When You’re Just Starting Out The first years as a student or recent graduate — это не просто лекции и первые собеседования, это еще и хаос с деньгами. Доход нестабилен, расходы растут, в голове каша из кредитных карт, студенческих займов и непонятных банковских терминов. Частая ошибка новичков — думать: «Раз…

-

Straightforward guide to opening a bank account for beginners

Why Bank Accounts Still Matter Пicture money stored under a mattress: it doesn’t earn anything, it’s easy to steal, и никак не помогает вам строить кредитную историю. Современный банковский счет решает все эти проблемы сразу. Он дает безопасное место для хранения средств, упрощает платежи и создает цифровой след вашей финансовой жизни. Даже если вы пользуетесь…

-

Saving for a family vacation on a budget: smart tips to reach your travel goal

Why saving for a family vacation on a budget still matters in 2025 Planning a family vacation on a budget в 2025 году звучит немного иначе, чем десять–двадцать лет назад, но суть осталась той же: вы хотите отдохнуть вместе, не влезая в долги. До появления лоукостеров, кэшбэк‑карт и онлайн‑агрегаторов путешествия для обычной семьи часто были…

-

Smart savings challenges to boost your finances and build lasting wealth

Why Smart Savings Challenges Matter in 2025 Smart savings challenges — это не детские игры с копилкой, а управляемые финансовые эксперименты. В 2025 году инфляция, нестабильный рынок труда и рост подписочных расходов делают пассивное «экономить, когда получится» неработающей стратегией. Челленджи переводят абстрактную цель в чёткие правила: сумма, период, триггеры пополнений и система контроля. В итоге…

-

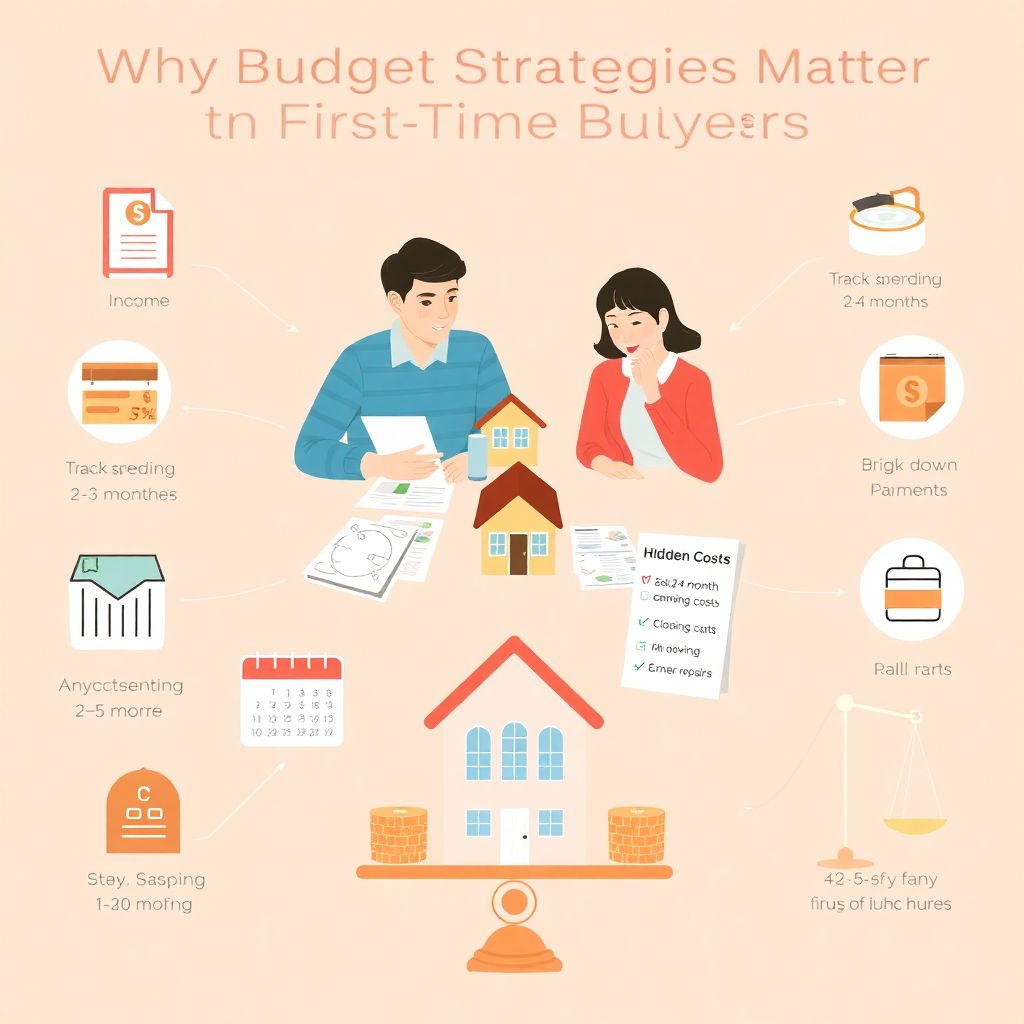

First-time home buyer budget strategies to save more and afford your first home

Why Budget Strategies Matter for First-Time Buyers Buying your first place feels huge because, честно говоря, это и есть огромное решение. Вы одновременно решаете, где жить, как вкладывать деньги и сколько свободы готовы отдать банку. Грамотные first time home buyer tips помогают не только накопить на взнос, но и не застрять в «дом с красивым…

-

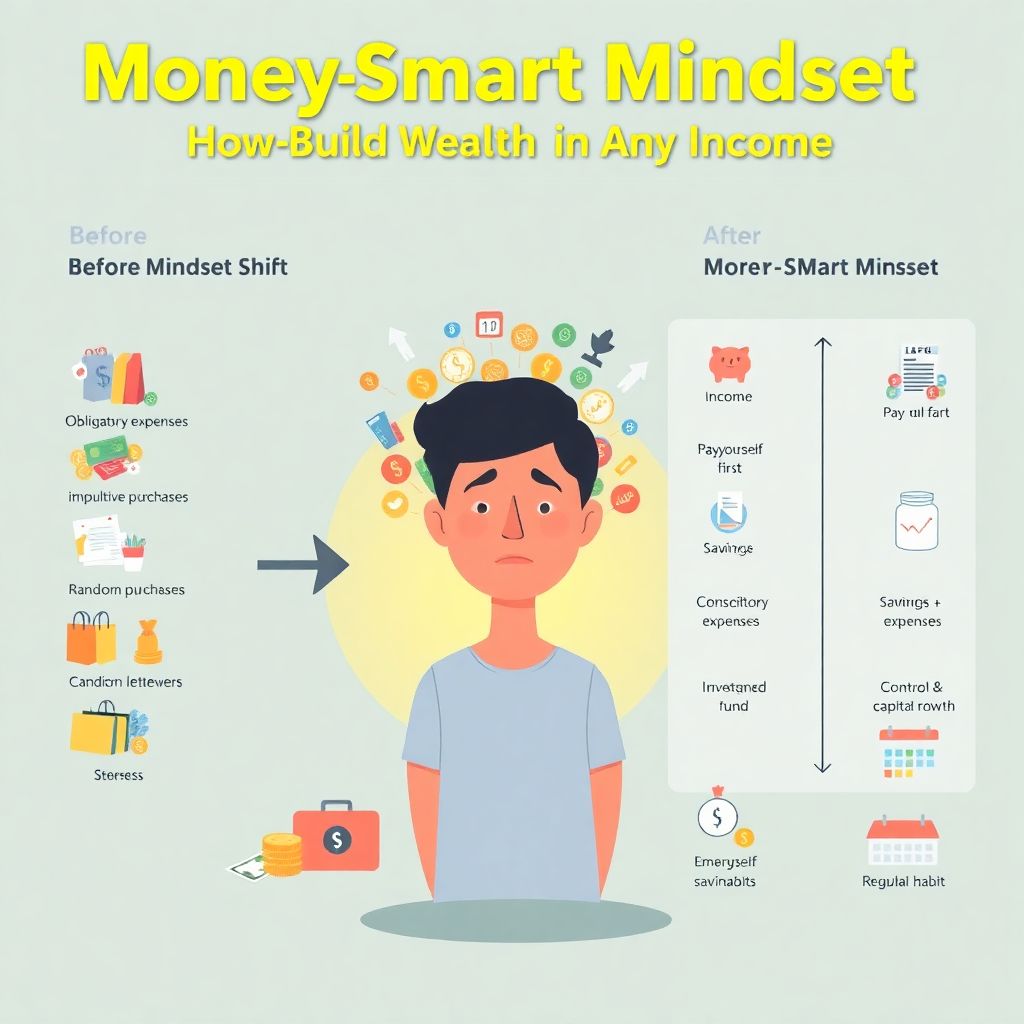

Money-smart mindset: how to embrace wealth at any income and grow your finances

Why “Money‑Smart Mindset” Matters More Than Your Paycheck Most people secretly believe wealth starts with a big salary. In reality, a money‑smart mindset is a set of repeatable mental habits: how you think about spending, saving, risk, learning и long‑term plans. Это не магия и не мотивационный трюк, а вполне технический навык обращения с ограниченными…

-

How to create a personal finance action plan to reach your money goals

Why a Personal Finance Action Plan Matters in 2025 От goals-on-paper к живой системе решений В 2025 году личные финансы уже не ограничиваются одним-двумя счётами и записной книжкой. Подписки на сервисы, микроплатежи, инвестиционные приложения и BNPL‑сервисы делают денежные потоки более фрагментированными, и без продуманного плана легко потерять контроль. Personal finance action plan — это не…

-

Personal finance for beginners on a tight schedule: simple steps to start today

Being good with money when you barely have time to sleep, let alone “optimize cash flow”, sounds unrealistic. Yet that’s exactly when smart habits matter most. Instead of starting with a massive personal finance course for beginners, we’ll focus on a few moves you can run on autopilot. Ниgher income helps, но pattern важнее: where…

-

Small changes that create big results in life, work and personal growth

Why tiny shifts beat radical overhauls We like bold promises: “New life in 30 days”, “Total reset on Monday”. Yet the data on behavior change says something quieter: systems win, willpower loses. Small changes look boring, but they slip under the radar of your inner resistance and, over months, перестраивают весь маршрут. Think of a…