Why Small Changes Make a Big Difference in Financial Habits

Small actions, repeated consistently, can shape your financial future more than any drastic overhaul. In 2025, with inflation still hovering around 3.2% globally and digital payments becoming the norm, building resilient money habits is not just smart — it’s essential. The key lies in understanding that financial habit formation doesn’t require radical steps. Instead, it thrives on minor, sustainable changes that compound over time.

Take for example, Anna, a freelance designer from Berlin. In 2022, she began rounding up each purchase to the nearest euro and saving the difference. By 2024, she had accumulated over €1,200 — enough to cover her business insurance for the entire year. This kind of micro-saving is a textbook application of small changes for financial success.

Understanding the Psychology of Habit Formation

Habits form when a behavior is repeated in a consistent context. Financial habits are no different. According to a 2023 study by the European Financial Behavior Institute, it takes an average of 66 days to solidify a money-related habit, such as tracking expenses or meal planning to reduce dining out.

The brain rewards predictability. When you automate savings or set spending limits using mobile banking apps, you reduce the cognitive load required to make financial decisions. This is one of the most effective money management habits you can build — letting systems work for you.

Technical Insight: The 1% Rule

One of the most powerful financial discipline strategies is the 1% rule. This involves increasing your savings or investment contributions by just 1% each month. If you start with $100 in January, by December you’ll be saving $112 — a 12% increase with minimal lifestyle impact. Over five years, assuming a 5% annual return, this can grow into a substantial emergency fund or seed capital for a side business.

Common Obstacles and How to Overcome Them

Many people struggle with consistency. Life gets in the way — unexpected bills, job changes, or even emotional spending. This is where financial habit building tips become crucial. One proven method is the “if-then” strategy. For example: *If I get a bonus, then 50% goes directly into savings*. This pre-commitment tactic helps avoid impulsive decisions.

Another challenge is overestimating short-term progress. People expect instant results and get discouraged when savings grow slowly. Here’s where tracking comes in. Using digital tools like Mint or YNAB (You Need A Budget), you can visualize your progress and stay motivated.

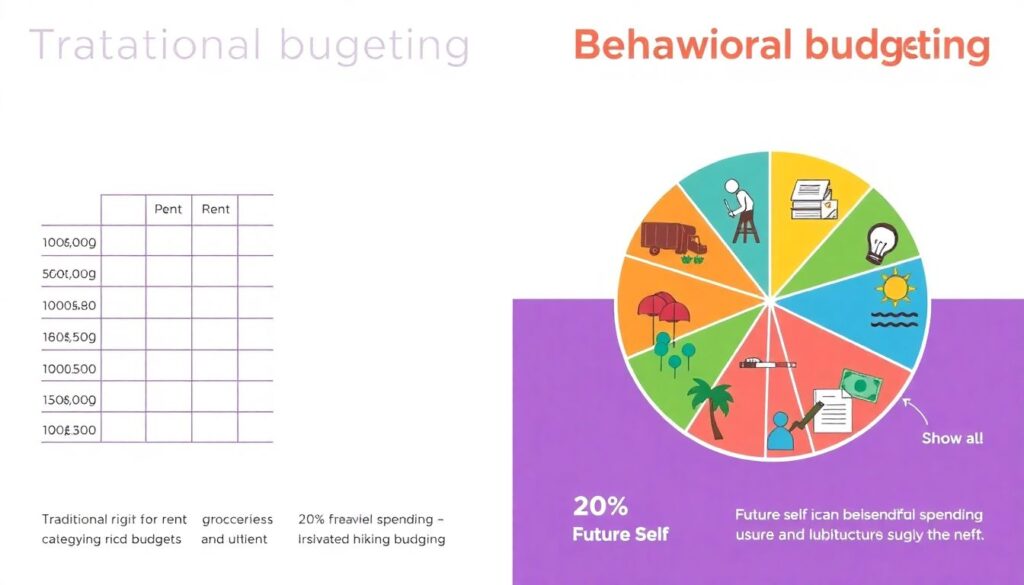

Technical Insight: Behavioral Budgeting

Behavioral budgeting aligns your spending with your values. Instead of rigid categories, it focuses on goals. For instance, allocating 30% to “freedom spending” (travel, hobbies) and 20% to “future self” (investments, retirement). This flexible approach has shown a 27% higher adherence rate in a 2024 study by the American Institute of Financial Wellness.

Real-Life Application: Building Habits in the Gig Economy

With 38% of the global workforce engaged in freelance or contract work as of early 2025, traditional budgeting methods are becoming outdated. Freelancers like Marco, a software developer from São Paulo, use irregular income to their advantage. He applies the “pay yourself first” rule — setting aside 30% of every payment before covering any expenses. Over 18 months, this helped him build a three-month emergency fund, even during periods of low client activity.

This method is one of the most practical financial discipline strategies for those without fixed incomes. It also reinforces long-term thinking, a critical component in how to improve financial habits sustainably.

Forecast: What’s Next in Financial Habit Formation?

Looking ahead, the integration of AI in personal finance will redefine how we build habits. By late 2025, we expect major banking apps to include predictive budgeting — using AI to anticipate spending patterns and suggest micro-adjustments. These tools will not only track behavior but also coach users in real time, nudging them toward smarter decisions.

Moreover, gamification will play a larger role. Platforms like Cleo and Qapital already reward consistency with badges and streaks. Expect this trend to deepen, making financial discipline feel less like a chore and more like a game.

Technical Insight: Adaptive Savings Algorithms

Emerging fintech startups are developing adaptive savings algorithms that adjust your savings rate based on real-time cash flow. If your income dips, the algorithm lowers your savings goal temporarily. If it surges, the app boosts your contribution automatically. Early trials in the UK showed a 19% increase in user retention and a 34% improvement in monthly savings rates.

Conclusion: Start Small, Think Long

Forming effective money management habits in 2025 isn’t about overhauling your life. It’s about making tiny, intentional changes — like automating a $10 weekly transfer to savings or reviewing your bank statement every Sunday. These actions, while simple, build a foundation of discipline and awareness.

The future of financial habit formation lies in personalization, automation, and behavioral insight. But the principles remain timeless: consistency beats intensity, and small changes for financial success are the most sustainable path forward. Whether you’re living paycheck to paycheck or managing a growing portfolio, the right habits — built one step at a time — can transform your financial journey.