Most people stare at their paystub, squint at the tiny lines, and hope the final “Net pay” number is at least vaguely correct. If that’s you, don’t worry—you’re in very large company. This practical guide will walk you, step by step, through paycheck “darnings” (let’s read that as everything that can go wrong or get confusing with earnings and deductions) and the benefits that go with them, in a clear, down‑to‑earth way.

We’ll also compare разные подходы to solving the core problem: how to actually understand what’s happening to your money and benefits every pay period—and what to do when something looks off.

—

What You Actually Need Before You Start

Before you try to decode anything, gather a tiny “toolkit.” No, not a toolbox with a hammer—more like a few simple resources that will save you an hour of frustration.

At minimum, have:

– Your most recent paycheck stub (printed or PDF)

– Your benefits summary from HR or the employee portal

– A basic calculator or a paycheck calculator with benefits (online or app)

– Access to your employment contract or offer letter

If you work for a small business, there’s often less automation and more manual tweaks in the system. That makes clarity even more important, because a typo or a missed update can slip through more easily than in a huge, fully automated corporate payroll system.

—

How a Paycheck Is Built: The Big Picture

Think of your paycheck as a story with three main chapters: what you earned, what was taken out, and what’s left. The trouble is, that story is written in abbreviations, codes, and percentages.

To make sense of it, you need to understand how to read your paycheck stub deductions as a process, not as random lines:

– Gross pay – total earnings before any deductions (hourly rate × hours, plus bonuses, overtime, commissions).

– Pre‑tax deductions – things that reduce your taxable income: retirement contributions, some health premiums, HSA, FSA.

– Taxes – federal, state, local, Social Security, Medicare, plus any special local taxes.

– Post‑tax deductions – union dues, garnishments, some types of insurance, or voluntary after‑tax contributions.

– Net pay – the money actually hitting your bank account.

Once you see your paystub through that structure, every strange line item suddenly has a home.

—

Different Approaches to “Fixing” Paycheck Confusion

There are several ways people try to deal with paycheck confusion and benefit questions. Some are proactive, some are… let’s say more “ostrich with head in sand.”

1. The “Ignore It Unless It Hurts” Approach

You only look at the final net pay and maybe the vacation hours. If something feels off, you complain to HR. This takes the least time, but it means:

– You probably overpay taxes or miss benefits.

– Errors can go on for months (or years) before you notice.

2. The “Manual Detective” Approach

You sit with your stub and a calculator, re‑do the math, and cross‑check with your contract and benefits guide. This is accurate but time‑consuming, especially if:

– You have variable hours or overtime.

– There are multiple benefit plans and changing contribution rates.

3. The “Tool‑Assisted” Approach

You use an online paycheck calculator with benefits and plug in:

– Your gross pay

– Your tax filing status and allowances

– Your retirement and insurance contributions

Then you compare the tool’s output with your actual paystub. This middle path is usually the sweet spot: less time, more accuracy, and much easier for non‑finance folks.

In most real‑world situations, blending the manual detective and tool‑assisted methods gives the best payoff: you understand the basics, but you let software chew through the detailed arithmetic.

—

Step‑by‑Step: Reading Your Paycheck Like a Pro

Let’s go through a clear, repeatable process you can use every pay period. It’s not glamorous, but it’s fast once you’ve done it two or three times.

Step 1: Confirm the basics

Check your name, address, pay period dates, and pay rate (hourly or salary per pay period). Mistakes here can cascade everywhere else.

Step 2: Rebuild your gross pay

Manually compute what you should have earned:

– Hourly workers: hours × rate (including overtime with the correct multiplier).

– Salaried workers: annual salary ÷ number of pay periods, plus any bonuses or commissions.

Compare the result to the “Gross pay” line. If it’s off, flag it right away.

Step 3: Identify and sort deductions

Now work through the lines under deductions and mark each one as:

– Tax

– Pre‑tax benefit

– Post‑tax benefit

– Other (like garnishments or reimbursements)

You don’t need to memorize codes; you just need to recognize “This is tax” vs “This is my 401(k)” vs “This is health insurance.”

Step 4: Cross‑check with your benefits elections

Open your benefits summary from HR and confirm:

– Which medical/dental/vision plan you selected

– Your retirement contribution percentage

– Any extras (life insurance, disability, legal plan, etc.)

The dollar amounts on your stub should align with those elections. If your medical plan premium is supposed to be $120 per pay period and you’re being charged $160, something’s off.

Step 5: Run a quick external check

Use a payroll or benefits tool (or even a generic tax calculator) to run a rough estimate:

– Plug in your gross pay and filing details.

– Add your main pre‑tax deductions.

If the estimated net pay is close to your actual net, you’re probably fine. If it’s wildly different, you’ve found a problem worth digging into.

—

Understanding Benefits: More Than Just “Perks”

Benefits aren’t just extra goodies; they’re a major part of your total compensation. Two people with identical salaries can end up with very different real‑world value, purely because their benefit structures are different.

This is where employee benefits packages comparison becomes important. When you’re choosing between jobs or between plans in open enrollment, you’re not just comparing premiums; you’re comparing:

– How much the employer pays vs. you

– What’s covered and what’s excluded

– Deductibles and copays

– Retirement matching and vesting schedules

– Extra perks: wellness, education, remote stipends, etc.

A job with a slightly lower salary but excellent benefits can easily beat a higher‑paying job with weak or expensive coverage.

—

DIY vs. Employer‑Driven Benefits Management

Here’s another set of contrasting approaches: who does the heavy lifting when it comes to managing and understanding your benefits—primarily you, or your employer’s systems?

1. DIY‑Heavy Approach

Common in very small businesses or startups without robust HR:

– You fill out paper or basic digital forms.

– You keep your own records of what you signed up for.

– Corrections require emailing or calling someone directly.

Upside: more flexibility and sometimes more personal attention.

Downside: more room for human error and mismatches with payroll.

2. System‑Driven Approach

Found in companies that use modern payroll services with benefits administration:

– You enroll and change options through a self‑service portal.

– Salary and benefit changes sync automatically with payroll.

– You can often see simulations of how changes affect your take‑home pay.

Upside: fewer errors, more transparency, and fast updates.

Downside: it can feel rigid, and you depend on the system being set up correctly.

If your employer is still in the DIY world, it’s worth pushing (politely) for a better system. Even many smaller firms are moving toward integrated tools because they reduce headaches for everyone.

—

How Small Businesses Handle Paychecks and Benefits

If you work for a small company, the behind‑the‑scenes reality matters a lot to your paycheck. Owners face a choice:

– Keep everything in‑house with spreadsheets and basic software.

– Partner with specialized best employee benefits providers for small business that bundle payroll, HR, and benefits in one place.

From the employee’s perspective, the second option is usually better. You get:

– Clearer paystubs with standardized codes

– Fewer incorrect deductions and retroactive fixes

– An actual dashboard where you can see your benefit elections

From the employer’s angle, outsourcing costs money but reduces risk of compliance mistakes and angry conversations when someone’s paycheck comes out wrong.

—

Common Paycheck and Benefits Problems (And What to Do)

Even in good systems, things glitch. Here are regular “darnings” you might encounter and straightforward fixes.

Problem 1: Your net pay suddenly drops

Maybe your hours didn’t change, but the money in your account is noticeably lower.

Possible causes:

– Your benefit premiums changed at renewal.

– A one‑time bonus last period changed your tax withholding this period.

– You hit a Social Security tax limit or started a new deduction.

What to do:

– Compare your last two paystubs line‑by‑line.

– Circle anything new or any line that jumped a lot.

– Ask HR or payroll: “This line changed from X to Y—can you explain why?”

Problem 2: Missing or incorrect benefits

You enrolled in a plan, but you don’t see the deduction—or you see the wrong one.

Quick actions:

– Re‑open your enrollment confirmation to verify what you actually submitted.

– Check the effective date: some plans start the first of the next month.

– If something’s clearly wrong, contact HR with copies/screenshots, not just a vague complaint.

Problem 3: Taxes look way too high

People often panic when they first notice how much is being withheld.

Check:

– Your W‑4 or equivalent: filing status and dependents matter a lot.

– Whether your pre‑tax deductions are set up correctly.

– If a one‑time payment (bonus, payout) triggered higher withholding.

If needed, submit an updated tax form to adjust future paychecks—just avoid swinging from “over‑withheld” to “under‑withheld” and creating a tax bill later.

—

Quick Troubleshooting Checklist You Can Reuse

When something on your paycheck looks off, run this short checklist before you assume the worst:

– Did your pay rate, hours, or job role change recently?

– Did you modify any benefits during open enrollment or life events (marriage, birth, move)?

– Is this the first paycheck of a new year or benefit plan year?

– Are there any “retro” or adjustment lines you’ve never seen before?

If the answer to any of these is “yes,” there’s a good chance the change is legitimate—but it still needs to make sense to you.

—

Comparing Long‑Term Strategies: What Actually Works

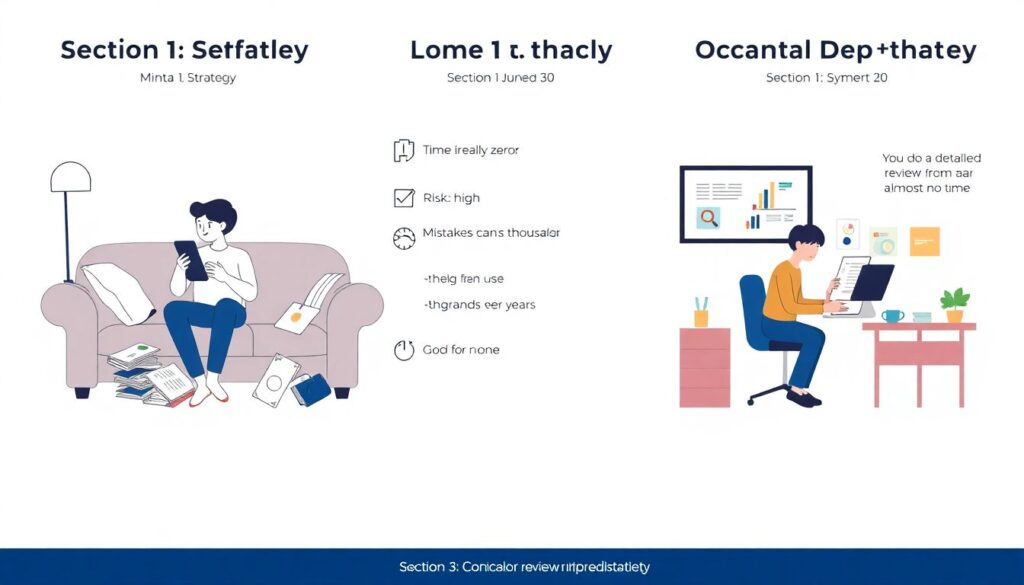

Let’s step back and compare three broad strategies over the long run:

1. Minimalist Strategy: Only react when it really hurts

– Time invested: almost zero.

– Risk: high. Mistakes can cost thousands over years.

– Good for: almost no one, honestly.

2. Occasional Deep‑Dive Strategy

– You do a detailed review once or twice per year (and after any big changes).

– You keep copies of key documents: offer letter, benefits summary, major pay changes.

– You use an external calculator to sanity‑check.

This is a nice balance: you’re not obsessing every payday, but big errors don’t go unnoticed.

3. System‑First Strategy

– You choose employers and tools that provide transparency by design.

– You lean heavily on integrated payroll and benefits platforms.

– You still do light checks, but the system does most of the heavy lifting.

Over time, this usually produces the best results with the least ongoing effort—especially when paired with solid questions from you whenever something changes.

—

Bringing It All Together

Understanding your paycheck and benefits is less about becoming a payroll expert and more about owning a simple, repeatable routine:

– Gather your “toolkit” (stub, benefits summary, calculator).

– Rebuild your gross pay and categorize deductions.

– Cross‑check with your elections and run a quick external estimate.

– Use a short troubleshooting checklist whenever something changes.

Once you’ve done this a few times, the mystery drains out of your paystub. Instead of guessing, you’ll know how to read your paycheck, spot errors early, and decide which mix of tools, HR support, and personal review works best for you.

That’s the real “practical guide” payoff: less confusion, fewer surprises, and more confidence that the money you earn—and the benefits you’re promised—are actually landing where they should.