Understanding Credit Building Without Borrowing

Building a solid credit history is essential for financial stability, but many people mistakenly believe that going into debt is the only way to achieve this. In reality, there are several intelligent strategies to establish and grow credit without accumulating unnecessary liabilities. These methods are especially useful for young adults, recent immigrants, or individuals recovering from financial setbacks. By leveraging modern financial tools and adopting disciplined habits, it’s possible to build credit safely and sustainably.

Comparing Different Approaches to Building Credit

There are multiple avenues for building credit without traditional debt, each with distinct features. One of the most effective tools is a secured credit card, which requires a refundable deposit and reports activity to credit bureaus. Unlike regular credit cards, you’re spending your own money, but still building a credit profile. Another option is becoming an authorized user on a trusted person’s credit card. This allows you to benefit from their good credit behavior without legal responsibility for the balance.

A more recent innovation is credit-builder loans, offered by credit unions or fintech companies. These loans hold the borrowed amount in a secured account, and only after the loan is fully repaid is the money released to you. Alternatively, rent and utility reporting services like Experian Boost or RentTrack allow your monthly payments to be included in your credit file, offering a passive way to build credit through bills you’re already paying.

Technology Tools: Pros and Cons

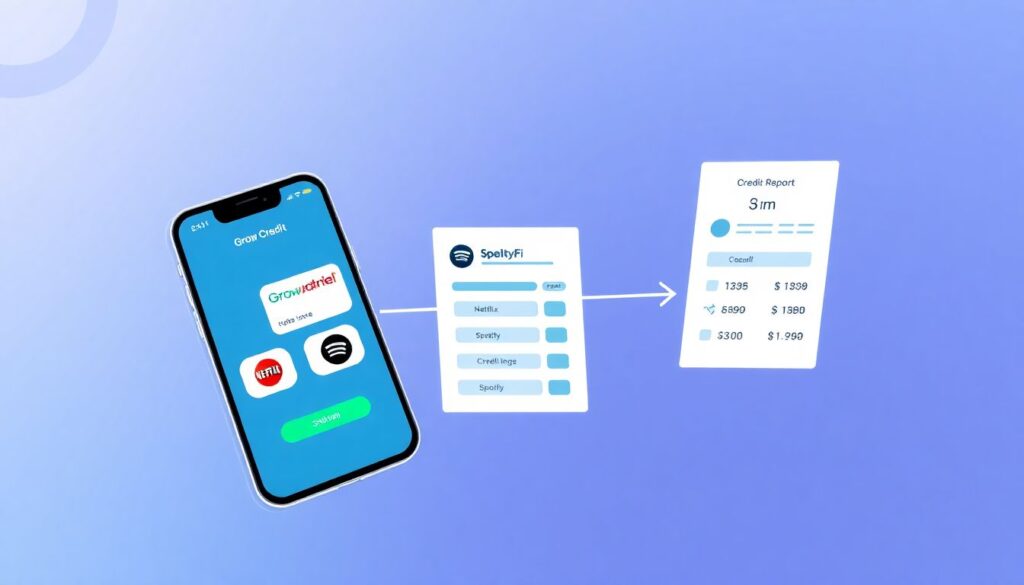

Modern financial technology has introduced a wave of apps and services that promise credit-building without debt. Apps like Grow Credit and StellarFi allow users to link recurring subscriptions (like Netflix or Spotify) or bills to a virtual credit line that gets reported to credit bureaus. The upside is convenience and automation—users don’t have to manage new loans or cards.

However, the downside lies in limited impact. These tools might not carry the same weight with all credit scoring models, and some lenders may not recognize alternative data. Additionally, some platforms charge monthly fees that can add up over time. Users should also be cautious with data-sharing practices, as some services monetize user behavior.

Case Study: Maria’s Journey with Experian Boost

Maria, a 26-year-old freelance graphic designer from Austin, had no credit history after years of avoiding credit cards. She started using Experian Boost, linking her utility and phone bills to her credit file. Within three months, her credit score rose from 0 to 645, enabling her to qualify for a low-limit secured card. A year later, she was approved for an auto loan with favorable terms—all without taking on debt she couldn’t manage.

Recommendations for Choosing the Right Strategy

Selecting the best method depends on your financial habits and long-term goals. If you’re comfortable with managing a card, a secured credit card offers control and flexibility. For those with irregular income or who prefer automation, rent reporting or subscription-based tools may be more suitable. Becoming an authorized user is ideal for those with access to a trusted friend or family member with a strong credit profile.

Always research the associated fees, reporting practices, and potential impact on your credit score. Avoid services that promise instant results or require large upfront payments. Focus on methods that promote consistent, positive behavior over time.

Trends in Credit Building for 2025

As 2025 approaches, the credit landscape is shifting toward inclusive data models. Major credit bureaus are increasingly integrating non-traditional data—like rent, utilities, and even streaming subscriptions—into their scoring algorithms. Fintech companies are also partnering with employers and banks to offer embedded credit-building tools in payroll systems and digital wallets.

Artificial intelligence is being used to personalize credit-building strategies based on spending patterns and financial goals. Additionally, there’s a growing emphasis on financial literacy, with platforms integrating education modules that guide users through credit basics.

Case Study: Jamal’s Fintech Solution

Jamal, a 33-year-old teacher in Chicago, used StellarFi to report his rent and phone payments. The app linked his bills to a virtual credit line, which was reported monthly to all three major bureaus. In just six months, his score improved by 80 points. This allowed him to refinance his student loans at a lower interest rate, saving thousands over time—without ever taking on new debt.

Final Thoughts

Building credit without going into debt is not only possible—it’s a smart financial move for many. By leveraging secured cards, rent reporting, and emerging fintech tools, individuals can establish strong credit profiles without the risks associated with traditional borrowing. As technology continues to evolve and credit bureaus embrace broader data sets, the path to good credit is becoming more accessible than ever. The key lies in consistent behavior, informed choices, and a long-term perspective.