Why Your Money Feels “Off” (Even When You Budget)

Ever looked at your bank statement and thought, “I’m not reckless… so why doesn’t this feel like the life I want?”

That gap between how you spend and what you actually care about is what we’re going to close. This is about how to align spending with financial goals and your deeper values so your budget starts feeling like a reflection of you, not a list of restrictions.

—

Tools You’ll Need Before You Start

Digital Tools (You Don’t Need All of Them)

To make this work, you’ll want at least a basic setup:

– A way to see all your accounts in one place (bank app or aggregator)

– A way to track where money goes (spreadsheet or app)

– A simple place to write and adjust goals (notes app, doc, or journal)

Many people like using the best budgeting apps to track spending by category so they can quickly see “eating out,” “housing,” “travel,” etc. But if you’re spreadsheet‑friendly, Google Sheets or Excel work just fine too.

—

Mental Tools (More Important Than the Apps)

You also need a few “mindset tools”:

1. Willingness to look at your numbers honestly

2. Curiosity instead of guilt

3. Permission to change your mind as your life changes

That last one matters: values shift. Your budget should be allowed to evolve too.

—

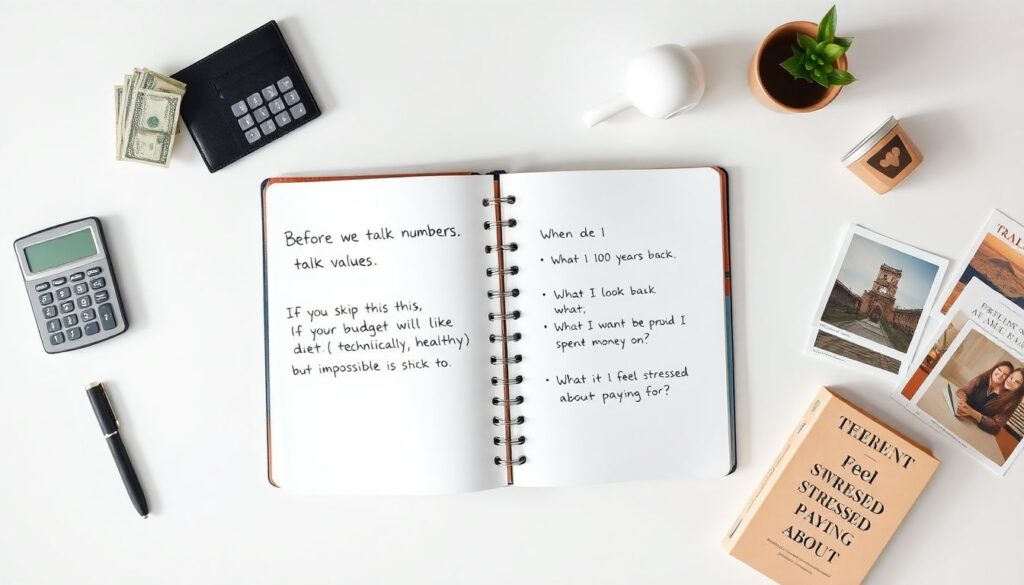

Step 1: Get Clear on Values Before You Touch the Budget

Name What Actually Matters (Not What “Should” Matter)

Before we talk numbers, we talk values. If you skip this, your budget will feel like a diet: technically “healthy” but impossible to stick to.

Ask yourself:

– When I look back 10 years from now, what do I want to be proud I spent money on?

– What do I never want to feel stressed about paying for?

– What am I totally okay sacrificing to make room for better stuff?

Write down 3–5 value themes. Examples:

– Freedom / flexibility

– Family / relationships

– Health / energy

– Growth / learning

– Creativity / experience

Keep it simple. “Family, freedom, health” is already enough to start.

—

Case Study: Anna, 29, “Good Employee, Stressed Human”

Anna earned decent money but constantly felt broke. When we talked, her values were:

– Relationships

– Adventure

– Security

Her actual spending? Huge chunk on rideshares, random online shopping, food delivery because she was always “too tired” to cook, and an expensive gym membership she barely used.

Nothing about her money said “adventure” or “security.” Once she saw that mismatch in black and white, she was finally ready to change how she planned her month.

—

Step 2: Translate Values Into Concrete Money Goals

Turn “I Value X” Into “I Will Fund Y”

Here’s where values based budgeting kicks in. You’re moving from “I care about health” to “I’m willing to put $150/month into things that actually help my health.”

For each value, assign:

– 1–2 specific financial goals

– A rough target amount

– A time frame

Example:

– Value: Freedom

– Goal: 3‑month emergency fund – $6,000 in 18 months

– Goal: Save for a solo trip – $1,800 in 12 months

– Value: Family

– Goal: $200/month for visits, gifts, shared experiences

Suddenly, your goals are not random; they’re rooted in what you care about most.

—

Case Study: Mark, 41, “Lots of Income, No Direction”

Mark was a high‑earning engineer. No debt, but also “no idea where the hell my money goes.” His values:

– Security

– Generosity

– Learning

We turned those into:

1. Maxing his retirement contributions over 3 years (security)

2. Setting up an automatic monthly donation to causes he cared about (generosity)

3. Creating a $150/month education fund for courses and books (learning)

He went from “I should probably save more” to a clear, value‑based flow of money every month.

—

Step 3: Audit Your Current Spending Without Beating Yourself Up

Look at the Last 1–3 Months

Pull 1–3 months of transactions from your bank and cards. Yes, it might be unpleasant. That’s okay. Your job is to observe, not shame yourself.

Sort spending into broad categories like:

– Housing & utilities

– Food (groceries vs eating out)

– Transportation

– Subscriptions

– Fun & entertainment

– Health & wellness

– Debt & savings

You can do this manually or use one of the best budgeting apps to track spending by category to speed it up.

—

Compare Reality to Values

Now ask:

– Which categories are clearly aligned with my goals and values?

– Which categories are “meh”—not bad, but not meaningful?

– Where is money leaking that I would rather redirect?

Look for patterns, not perfection. You’re hunting for 2–3 big areas to tweak, not 27 tiny optimizations.

—

Case Study: Dana, 35, “The $600 Subscription Problem”

Dana’s top values: creativity, friends, and health.

Her spending audit revealed:

– $600/month in subscriptions (software trials, fitness apps, streaming, paid newsletters)

– Very little going toward social experiences or creative tools she actually used

She canceled or downgraded more than half the subscriptions and reallocated:

– $150/month for art classes

– $100/month for dinners with friends

– $50/month for a quality sketching setup

Same income, radically different emotional return on each dollar.

—

Step 4: Build a Simple, Values‑Aligned Spending Plan

Design Your “Money Buckets”

Think in terms of buckets, not microscopic categories. A simple structure:

1. Fixed essentials (rent, utilities, minimum debt payments)

2. Goals (savings, investments, big upcoming expenses)

3. Values‑based “joy” spending

4. Everything else (and this is what gets squeezed first)

Allocate your monthly take‑home pay:

1. Cover essentials

2. Fund goals

3. Fill value‑based buckets

4. Whatever remains can go to lower‑priority wants

This order matters. Your future and values get funded before low‑value habits.

—

A 5‑Step Mini‑Process You Can Follow

1. Write down your monthly net income.

2. List essentials and subtract them.

3. Decide how much to send to each goal (emergency fund, debt payoff, travel, etc.)

4. Assign money to your 3–5 value‑based categories (e.g., “family visits,” “learning,” “wellness”).

5. Whatever is left becomes flexible “fun” or “buffer.”

Adjust until the numbers are realistic and you’re not setting yourself up to fail.

—

Step 5: Put It on Autopilot (So Willpower Isn’t the Plan)

Automate Anything That Matters Long‑Term

Where possible:

– Automate transfers to savings or investment accounts on payday

– Set recurring contributions for long‑term goals (emergency fund, vacation, house down payment)

– Keep bills on auto‑pay when safe to avoid late fees

This is how financial planning services for goal based budgeting operate behind the scenes: they try to remove as many manual decisions as possible. You can copy that logic even if you’re doing this solo.

—

Use Technology Strategically, Not Obsessively

Pick one primary system:

– A budgeting app with category rules

– A simple spreadsheet plus calendar reminders

– Cash envelopes for people who like physical limits

Then add light‑touch habits:

– Weekly 10‑minute check‑in

– Monthly “money date” to reset goals and review progress

You don’t need to track every coffee if that makes you resent the process. Track enough to see alignment trends.

—

Step 6: Adjust When Life Changes (Because It Will)

Revisit Your Values and Goals Regularly

Every 3–6 months, ask:

– Have my top 3 values changed?

– Are my goals still the right ones for this season of life?

– Does my spending still reflect those priorities?

This is especially crucial after major events: new job, move, baby, illness, breakup, or major windfall.

—

Case Study: Lila, 32, “From Travel to Parenthood”

Lila used to spend aggressively on travel; “freedom and experiences” drove everything. Then she had her first child.

Her new values: security, family, and time.

We reworked her plan:

– Reduced travel budget

– Increased emergency fund contributions

– Added a small monthly “babysitter and date night” category to support her relationship

It wasn’t about giving up who she was. It was about respecting the new chapter she was in.

—

Troubleshooting Common Problems

“I Keep Overspending in One Category”

Treat it as data, not failure.

Ask:

– Is this category actually more important to me than I admitted?

– Is the monthly limit unrealistic based on my lifestyle?

– Can I trade off another category instead of just “trying harder”?

Often, the fix is to increase that category slightly and cut something you truly don’t care about.

—

“I Feel Guilty Any Time I Spend on Myself”

Guilt is usually a sign of old money stories, not actual irresponsibility.

Try this:

– Set a specific “guilt‑free” amount for your top value categories

– Remind yourself: “This is exactly what this money is for.”

– Check that your essentials and goals are still funded

If those boxes are ticked, spending on aligned joy is not a problem—it’s the point.

—

“My Partner and I Value Different Things”

You don’t need identical values, but you do need shared minimums:

– Non‑negotiable bills

– Safety goals (emergency fund, insurance, debt payments)

– A baseline savings rate you’re both okay with

Beyond that, create individual “no questions asked” fun money. Each person can use their portion to fund their own values without debate.

—

“I’ve Tried Budgeting Before and Always Quit”

Most people quit because their plan was:

– Too rigid

– Too detailed

– Not connected to anything emotionally meaningful

Instead of tracking 40 categories, track these four:

1. Essentials

2. Goals

3. Values‑based joy

4. Everything else

If you’re still stuck, working briefly with a personal finance coach for budgeting and goals can help you build a system that matches your personality rather than fighting it.

—

Putting It All Together: A Quick Recap You Can Act On Today

1. List your 3–5 core values in life right now.

2. Turn each value into 1–2 concrete money goals.

3. Audit 1–3 months of spending and notice where money doesn’t match your priorities.

4. Build a simple plan that funds essentials, then goals, then values, and only then extras.

5. Automate as much as you can, and schedule a monthly 30‑minute check‑in.

6. Expect to tweak the system as your life and values evolve.

When your spending finally mirrors what you actually care about, money stops feeling like a constant argument and starts feeling like a tool you’re using on purpose. That’s the real win.