Why Your Side Hustle Needs Its Own Budget

If you’re bringing in extra cash from a side gig, that money can either change your life or quietly disappear into takeout and impulse buys. Learning how to budget side hustle income is the difference between “nice little bonus” and “this paid off my debt, funded my vacation, and boosted my investments.”

A side hustle is, по сути, a mini‑business. And any business that doesn’t track its money carefully burns out fast. The good news: you don’t need an MBA. You just need a simple system, a few decisions up front, and the discipline to stick with them.

—

Step One: Separate Your Money Like a Pro

Why one extra bank account changes everything

The first expert‑grade move is boring but powerful: open a separate account for your side gig.

When all your incomes and expenses mingle in one account, it’s nearly impossible to see if your hustle is actually profitable. By running all side hustle income and all related expenses through a dedicated account, you create a natural “mini‑P&L” (profit and loss) for yourself.

Most financial planners now call this the baseline for side hustle income planning and budgeting tips, because it:

1. Makes taxes easier

2. Exposes hidden costs

3. Helps you avoid overspending your profits

One short visit to your banking app, and you’ve already made budgeting twice as simple.

—

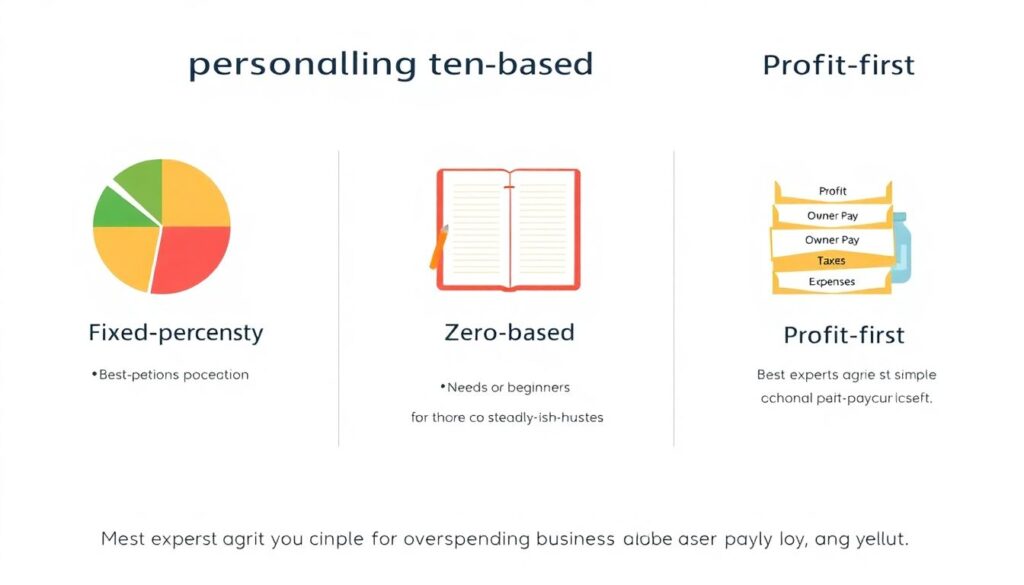

Three popular approaches to budgeting a side hustle

Let’s compare three real‑world ways people structure a side hustle budget.

1. The Fixed‑Percentage Method

You decide up front: X% for taxes, Y% for business, Z% for you. For example:

– 30% → Taxes

– 20% → Business expenses & growth

– 50% → Personal spending, savings, investments

This is the cleanest system for beginners. Each time money lands, you slice it into the same proportions.

2. The Zero‑Based “Every Dollar Has a Job” Method

Originating from business and nonprofit budgeting, this approach assigns a task to every single dollar: hosting fees, software, gear, marketing, debt payoff, emergency fund, personal fun money, etc. Nothing is left “floating.”

This method is more work but gives you full control and visibility—especially if your income is lumpy or seasonal.

3. The Profit‑First Method

Inspired by the business framework “Profit First,” you pay yourself first. Each time you get paid, you *immediately* transfer a set profit percentage to a “do not touch” account. Then you run the hustle on what’s left.

This method forces you to build a buffer and prevents the “I reinvested everything and still made nothing” problem.

—

Which approach fits whom?

Short version:

– Fixed‑percentage → Best for beginners and those with steady-ish income.

– Zero‑based → Best for analytical minds and complex side hustles.

– Profit‑first → Best if you’re prone to overspending “for the business” and never paying yourself.

Most experts agree: start simple with a fixed‑percentage approach, then upgrade to a hybrid once you understand your numbers.

—

Tech Tools: Apps, Spreadsheets, or Old‑School Envelopes?

Comparing the main approaches

There are three big categories for managing the money side:

1. Manual (notebooks, envelopes)

2. Spreadsheets (Excel, Google Sheets)

3. Apps (specialized budgeting and accounting tools)

Each has trade‑offs in time, precision, and flexibility.

—

Pros and cons of technology for side hustlers

Digital tools have exploded, and choosing the best budgeting apps for side hustle money can feel like a part‑time job on its own. Here’s how experts typically break it down.

Apps – Pros

– Automatic transaction imports from your bank

– Easy to categorize side hustle vs personal spending

– Nice visual dashboards to see income, expenses, and trends

– Push notifications that nudge you before you overspend

Apps – Cons

– Subscription fees that eat into small profits

– Learning curve; some are overkill for simple gigs

– Data privacy concerns if you connect every account everywhere

Spreadsheets – Pros

– Total flexibility; you can build the exact system you want

– Free or very cheap

– Great for building custom reports (e.g., profit by project or client)

Spreadsheets – Cons

– Fully manual unless you set up bank exports

– Easy to make formula errors that throw off your numbers

– Require discipline to update at least weekly

Pen and paper – Pros

– Zero tech overhead

– Writing numbers by hand increases awareness and control

Pen and paper – Cons

– No automation, no backups, easy to lose

– Hard to analyze patterns over months and years

In practice, most 2025 side hustlers end up with a hybrid: an app for real‑time tracking plus a simple spreadsheet for higher‑level planning.

—

Expert‑backed setup: a simple hybrid system

Financial coaches who specialize in self‑employed and gig workers often recommend:

– A free or low‑cost budgeting app connected to your “side hustle” bank account for day‑to‑day tracking.

– A monthly spreadsheet review to calculate true profit, tax savings, and progress toward goals.

You get automation where it matters, but you still sit down with the numbers so nothing important hides behind a pretty graph.

—

Income, Expenses, Profit: Know What’s What

How to track expenses and profits from side hustle

If you only remember one process, make it this one.

Each month (or each payout period), do a quick three‑step review:

1. Total your income

– Add all the payments from clients, platforms (Uber, Etsy, Upwork, etc.), and affiliate programs.

2. Total your business expenses

– Include not just obvious tools (software, materials) but also indirect costs: a portion of your phone bill, internet, mileage, transaction fees, marketplace commissions.

3. Calculate profit

– Profit = Income − Expenses − Tax Set‑Aside

This simple formula tells you if your “profitable” hustle is actually just an expensive hobby.

—

Realistic tax planning (instead of panicking in April)

Many people learn how to manage taxes for side hustle income the hard way: a scary tax bill after their first good year. You can avoid that with one rule experts repeat constantly:

> “Treat taxes like a non‑negotiable business expense, not a surprise.”

In practice:

– Set aside 25–30% of your net side hustle income (after direct expenses) in a separate “tax” savings account.

– If your country allows it, make quarterly estimated payments to avoid penalties.

– Keep digital copies of all receipts and invoices; even photos are fine if they’re clear.

A quick check with a local tax professional is worth it the moment your side income becomes consistent. They can tell you which costs are deductible and how to structure things if you grow.

—

Allocating Your Side Hustle Money: A Practical Blueprint

A simple percentage‑based model

Here’s a starter structure many financial planners like for part‑time side gigs:

1. 30% – Taxes

2. 20% – Business costs & growth (gear, marketing, training)

3. 30% – Long‑term goals (emergency fund, investments, debt payoff)

4. 20% – Guilt‑free spending (the fun part)

You can flex the numbers, but the logic stays: cover your obligations first, then build stability, then enjoy the reward.

—

Zero‑based twist for more control

If your income is variable, a pure percentage model can feel too vague. That’s where a zero‑based method helps:

– Start each month with your expected minimum income (be conservative).

– Assign specific amounts to categories in this order:

1. Taxes

2. Fixed business costs (subscriptions, tools)

3. Variable business costs (ads, materials)

4. Debt payments & savings

5. Personal fun money

– If actual income beats the minimum, you “re‑budget” the extra, usually sending most of it to savings or debt.

This strategy smooths out the stress of unpredictable months.

—

Using Apps in 2025: What Actually Works for Side Hustles

What experts look for in money apps

When advisors talk about the best budgeting apps for side hustle money, they focus less on brand names and more on features:

– Ability to tag transactions as business vs personal

– Easy category customization (e.g., “client gifts,” “ad spend,” “course materials”)

– Clean income vs expense reports over time

– Simple export to CSV for taxes or deeper analysis

– Cross‑platform access (phone + laptop)

They also tend to favor apps that don’t try to do everything. An app that’s great at clean tracking often beats a “do it all” financial super‑app that confuses you.

—

Pros and cons of going “all‑in” on apps

In 2025, almost everything can be automated—bank feeds, receipt scanning, tax estimates, even client invoicing. That’s powerful, but there’s a catch.

Upside of going all‑in on tech

– You save hours of manual work every month

– You catch recurring subscriptions you forgot about

– You can quickly see which products or clients are most profitable

Downside

– If you don’t understand the basics, you can blindly trust incorrect categories or reports

– Switching apps later can be painful if your entire history is locked in one ecosystem

The consensus among experts: let technology speed you up, but not replace understanding. You still need to know what “profit,” “margin,” and “cash flow” mean in your own numbers.

—

Common Mistakes New Side Hustlers Make

1. Treating all incoming money as “free cash”

If you spend 100% of each payout, you’re guaranteed future stress. Taxes will show up. Gear will break. Clients will ghost. A budget is how you pre‑pay for uncertainty.

—

2. Ignoring “hidden” business expenses

Many side hustlers undercount costs like:

– Software you “were going to cancel” months ago

– Small upgrades (lights, mics, props, samples) that add up

– Gas, parking, transit, and delivery fees

– Transaction fees from payment processors and marketplaces

Once you log these consistently for a few months, you’ll see why honest pricing matters.

—

3. Mixing personal and business money

This seems harmless until you sit down to figure out your profit, or your accountant asks for “all deductible expenses” for the past year. Separate accounts save hours and reduce costly mistakes.

—

Trends in Side Hustle Budgeting for 2025

Trend 1: Micro‑automation for solo earners

Instead of giant all‑in‑one software, we’re seeing small tools that do one thing extremely well: mileage trackers, receipt scanners, invoice bots that follow up on late payments automatically. These tools reduce admin time so you can focus on work that pays.

—

Trend 2: “Portfolio” side hustles and unified dashboards

Many people in 2025 don’t have one side hustle; they have three or four income streams: content creation, freelance work, a digital product, maybe rideshare on weekends. Budgeting is shifting from “one gig’s budget” to “portfolio of small incomes.”

That’s why dashboards that bring multiple platforms into one view—showing total income, total fees, and overall profit—are becoming a major focus for both app developers and advisors.

—

Trend 3: Tax‑first planning

With more countries tightening rules around digital & platform work, experts strongly emphasize proactive tax planning. People now look up how to manage taxes for side hustle income as early as their first or second payout instead of waiting for a problem.

This trend is pushing better education, clearer online calculators, and easier ways to pay estimated taxes directly from your side hustle accounts.

—

Putting It All Together: A Simple Weekly Routine

A 20‑minute system that keeps you on track

Here’s a practical routine many financial coaches recommend. Once a week:

1. Open your side hustle bank account and apps

2. Categorize new transactions (income, expense, transfer)

3. Move your percentages: taxes → tax account, profit → savings, etc.

4. Update your spreadsheet with total income, total expenses, profit

5. Review your goals: Are you on track for debt payoff, savings, or specific purchases?

This is how to budget side hustle income in a way that feels controllable instead of overwhelming—small, regular check‑ins instead of massive, stressful marathons at tax time.

—

Final Expert Recommendations

What money pros want you to remember

– Start simple, then refine. A separate account + basic percentage plan beats a “perfect” system you never use.

– Respect your time. If a tool or method takes more time than it saves, change it.

– Pay yourself like a real worker. Give your future self a raise by dedicating a chunk of profit to savings and investments, not just current lifestyle.

– Measure what matters. Focus on a few key numbers: total income, total expenses, profit, and tax set‑aside.

– Review regularly. Once a week and once a month: that’s where the real control comes from.

If you build these habits now, your side hustle stops being “extra” and starts being strategic—a reliable engine that moves you toward the life you actually want.