Category: Investment Insights

-

Charitable giving strategies for tax efficiency: how to maximize deductions

Нobody eagerly waits for tax season, but if you’re donating money anyway, it makes sense to make every доллар work и на благотворительность, и на снижение налога. Charitable giving strategies for tax efficiency — это не про «обман системы», а про осознанный выбор форматов пожертвований, сроков и инструментов. Ниже разберём, как разные подходы действительно работают…

-

Long-term investment strategies for beginners to build wealth with minimal risk

Understanding Long-Term Investment in 2025 Long-term investing remains a cornerstone of personal wealth building, especially in the face of evolving market dynamics in 2025. With the rise of artificial intelligence in financial analytics, the democratization of investing through low-cost platforms, and heightened awareness of sustainable investing, beginners now have more tools and opportunities than ever….

-

Education savings strategies for every stage of life to secure your financial future

Essential Tools for Saving on Education at Any Age When it comes to saving for education throughout life, choosing the right financial tools makes all the difference. Depending on your age or your child’s, different accounts and strategies will suit your needs. One of the most popular options in the U.S. is the 529 College…

-

Cost-cutting kitchen hacks to save money and live frugally every day

Smart Kitchen Strategies for Frugal Living: How to Cut Costs Without Compromising Quality In the pursuit of frugal living, the kitchen often becomes the frontline where savings and sustainability intersect. From home cooks to seasoned meal preppers, many are adopting innovative cost-cutting hacks that not only reduce grocery bills but also minimize waste and energy…

-

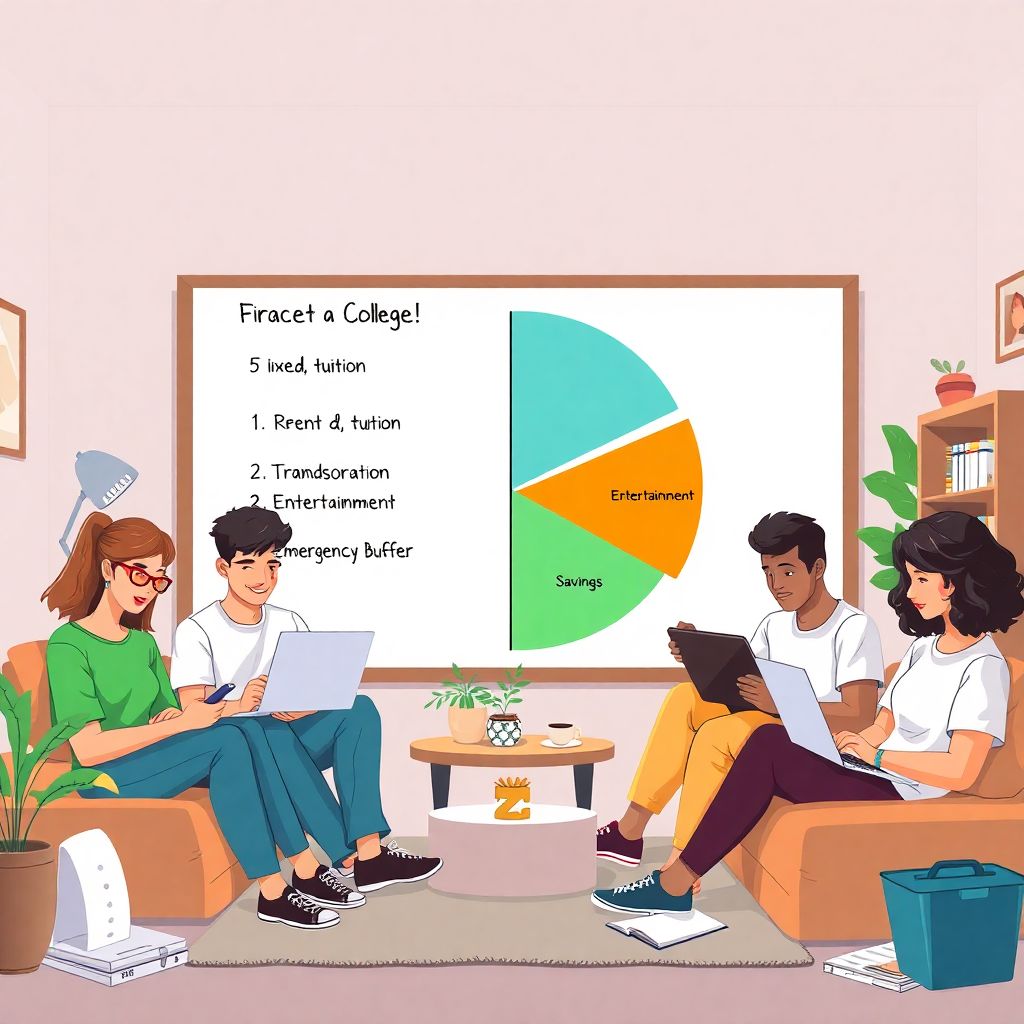

College budget planning: how to build a college budget that works for students

Understanding the Basics of a College Budget A college budget is a structured financial plan that helps students manage their income and expenses while pursuing higher education. It includes tracking tuition, housing, food, transportation, books, and discretionary spending. The goal is to ensure that students live within their means, avoid unnecessary debt, and develop lifelong…

-

Student loan refinancing pros and cons explained to help you make the right decision

Historical Background of Student Loan Refinancing Student loan refinancing emerged as a financial tool in the early 2000s, gaining momentum as higher education costs surged and borrowers sought relief from rising interest rates. Originally limited to private loan consolidation, the refinancing market expanded significantly after the 2008 financial crisis. Banks and credit unions began offering…

-

Mindful spending to align your purchases with personal values and financial goals

Understanding Mindful Spending: A Shift Toward Purposeful Consumption What Is Mindful Spending and Why It Matters Mindful spending is the practice of aligning your financial decisions with your personal values, long-term goals, and emotional well-being. Unlike impulsive buying or unconscious consumption, this approach encourages reflection before making purchases. At its core, mindful spending promotes financial…

-

Financial habit formation starts with small changes for long-term money management success

Why Small Changes Make a Big Difference in Financial Habits Small actions, repeated consistently, can shape your financial future more than any drastic overhaul. In 2025, with inflation still hovering around 3.2% globally and digital payments becoming the norm, building resilient money habits is not just smart — it’s essential. The key lies in understanding…

-

Cost-benefit analysis for personal purchases to make smarter financial decisions

Historical Context of Cost-Benefit Analysis in Personal Finance Cost-benefit analysis (CBA) has its roots in early economic theory, particularly in the work of 19th-century economists like Jules Dupuit and Alfred Marshall, who explored how individuals make rational decisions by weighing costs against benefits. Originally developed for large-scale infrastructure projects and public policy decisions, the methodology…

-

Financial decision-making frameworks to improve everyday money choices and budgeting

Redefining Money Choices: How to Build Smarter Financial Decision-Making Frameworks in 2025 Every day, we make dozens of financial decisions — from choosing whether to cook at home or order takeout, to deciding how much to save for retirement. And while the stakes may vary, each choice subtly shapes our financial future. By 2025, the…