Category: Saving Strategies

-

Tax-advantaged accounts explained: 401(k), Ira and roth Ira for smarter saving

Why Tax-Advantaged Accounts Are Your Secret Superpower When people talk about “getting rich slowly but surely”, чаще всего они даже не упоминают главный инструмент — налогово-льготные счета. 401(k), традиционный IRA и Roth IRA — это не просто скучные аббревиатуры из документов отдела кадров, а реальный способ сделать так, чтобы ваши деньги росли быстрее, чем налоговая…

-

Pay off credit card debt: from overwhelmed to organized with a step-by-step plan

Why Your Credit Card Debt Feels So Overwhelming If your credit cards are maxed out and minimum payments keep creeping up, you’re not alone and you’re definitely not “bad with money.” In 2024, U.S. credit card balances passed $1.1 trillion, and average interest rates pushed above 20%. That combo makes even small balances feel like…

-

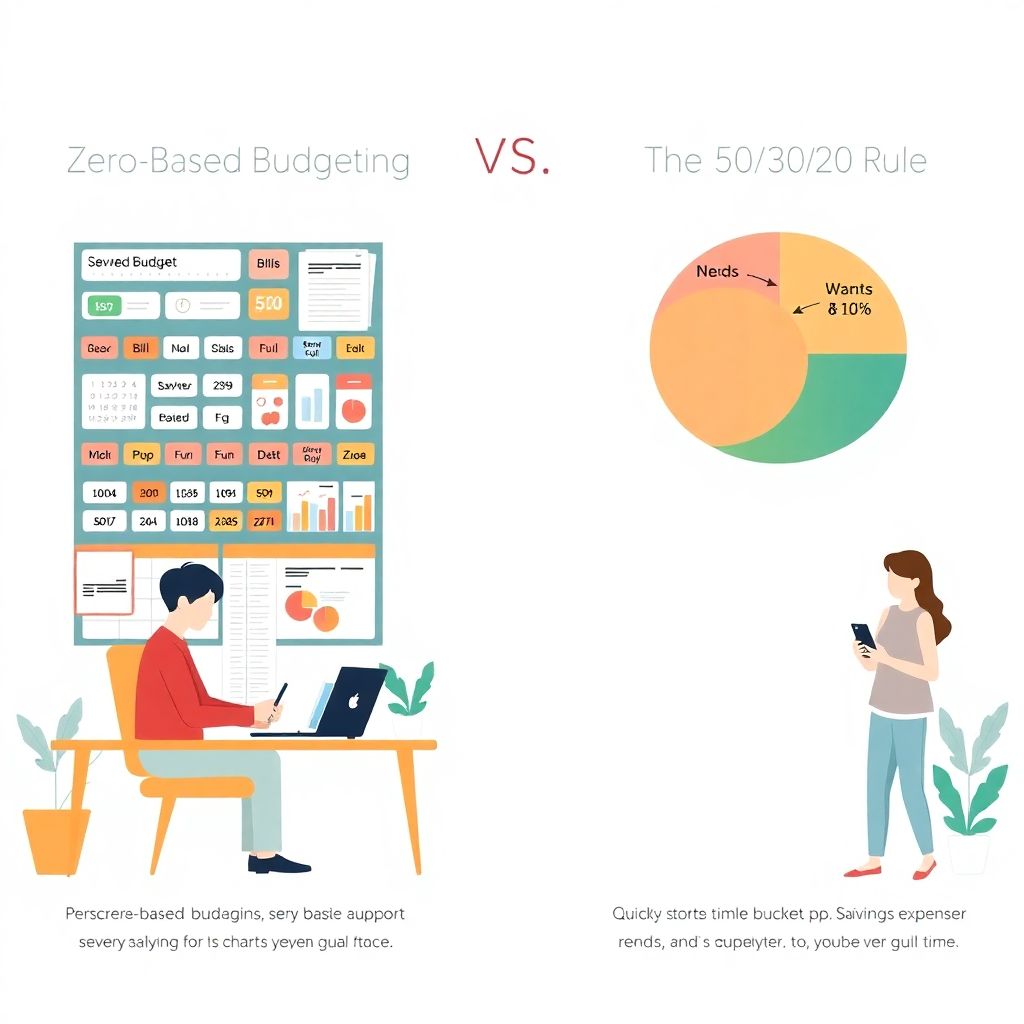

Zero-based budgeting vs 50/30/20 rule: choosing the best method for your money

Understanding the Two Budgeting Frameworks Zero-Based Budgeting in Plain Language Zero-based budgeting sounds fancy, but the idea is simple: every единица your income gets a specific job before the month starts. You “give a name” to every dollar, euro or рубль — bills, groceries, savings, debt, fun — until there’s literally zero left unassigned. That…

-

The psychology of money: mindset shifts for smarter financial decisions

The quiet engine behind every money choice We like to believe our financial life is the result of math: income, expenses, compound interest. In reality, it’s ruled by stories, fears and habits we picked up long before our first paycheck. The psychology of money explains why two people with the same salary make totally different…

-

How to start investing with $50 a month: step-by-step beginner guide

Why Starting with Just $50 a Month Actually Works Most people delay investing because they think it’s a game for rich folks in suits. In reality, learning how to start investing with little money is exactly how many people quietly build wealth over time. Fifty dollars a month might not feel like much, but combine…

-

How to negotiate lower interest rates on credit cards and personal loans

Why Negotiating Your Interest Rate Is Absolutely Worth It Most people quietly pay what the bank tells them and never even try to negotiate lower interest rate on credit card or loan products. Но lenders actually change rates all the time — they just usually do it for people who ask. Even a small cut,…

-

Home loan options for first-time buyers: guide to choosing your first mortgage

Home Loans in 2025: Why Buying Your First Place Стill Feels So Complicated If you’re trying to buy your first home in 2025, you’re not imagining it — it *is* harder than it was для родителей. Цены выше, ставки скачут, требования банков пугают. Но одновременно рынок стал более гибким: появилось больше программ, цифровых сервисов и…

-

Educational debt management for parents: key strategies to protect family finances

Educational Debt Management for Parents: Как не утонуть в кредитах за образование Когда родители берут на себя студенческие кредиты, это почти всегда про любовь и желание дать ребёнку лучший старт. Но за этим благим намерением легко спрятаны проценты, сложные договоры и десятилетия выплат. Управление долговой нагрузкой за образование — это уже не просто «платить по…

-

How to build a budget that supports your values and goals

Why “Value-Based Budgeting” Works Better Than Willpower Most people secretly know they “should” budget, but the word itself звучит как приговор: ограничения, таблицы, отказ от удовольствий. Проблема не в цифрах, а в том, что обычный бюджет пытается силой воли победить ваши естественные желания. Подход, о котором мы поговорим, другой: вы выстраиваете деньги вокруг своих ценностей,…

-

Smart saving techniques for big goals to reach your financial dreams faster

Why “Smart Saving” Looks Different in 2025 In 2025, saving money for big goals is less about cutting every coffee and more about using tech, automation, and psychology to your advantage. Open banking, AI-powered analytics, and automatic savings apps for big financial goals radically simplify what used to be a manual, boring process. The core…